What is it?

BIR Form 2551Q, also known as the Quarterly Percentage Tax Return, is a tax imposed on individuals/businesses that sell/lease goods or services that are exempt from Value Added Tax (VAT) with annual sales not exceeding 3,000,000 PHP.

Currently, the updated version of this form comes with additional ATCs (Alphanumeric Tax Codes) such as PT010, PT040, and many others. To learn more about how Fast File has adapted to the changes brought about by the C.R.E.A.T.E. law, check out this blog.

Who needs to file?

Taxpayers who are VAT-exempt with annual revenues not more than 3,000,000.00 (PHP)

Financial institutions such as banks, finance companies, agents of life insurance companies (foreign), and any related financial intermediaries

Franchisees of gas/water utilities, radio/TV broadcasting with revenue not more than ten(10) million pesos

Domestic and international air/shipping carriers

When to file?

Under Republic Act No. 10963, also known as the Tax Reform for Acceleration and Inclusion (also known as the TRAIN Law), 2551-Q forms shall be filed every 25th day after the taxable quarter.

How to File?

To file a BIR Form 2551-Q in Fast File, follow the steps below:

STEP 1: From your portal, click on the Start Return button.

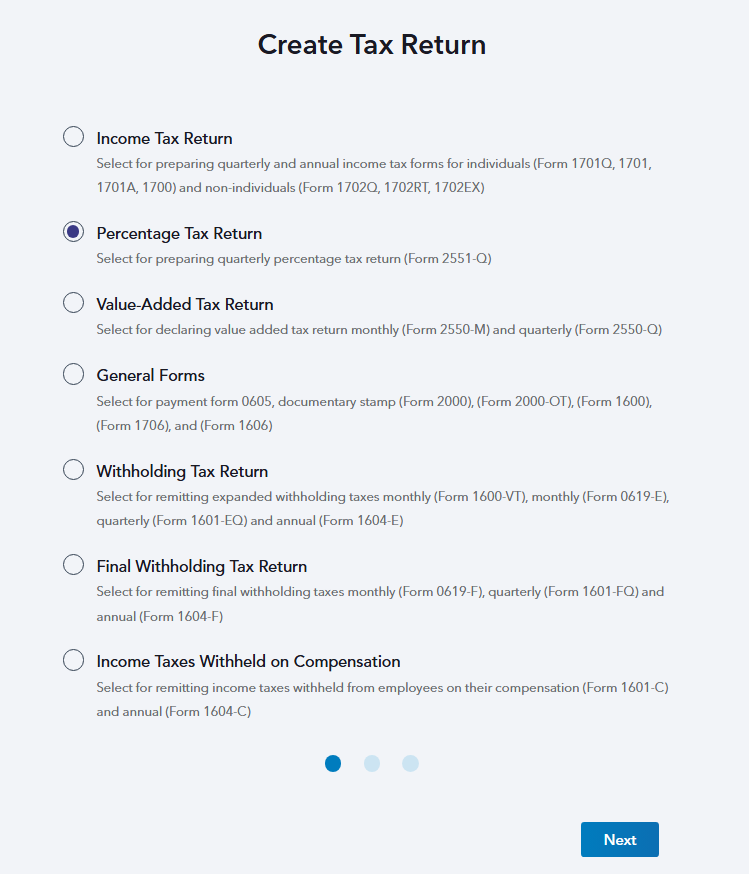

STEP 2: Select Percentage Tax Return and hit Next.

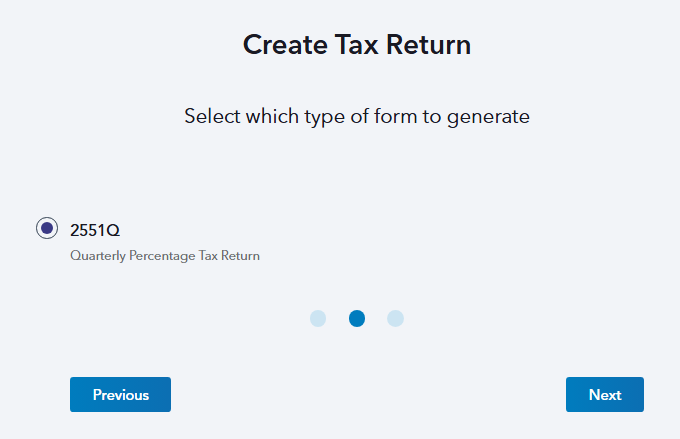

STEP 3: 2551Q is automatically selected so just proceed by clicking the Next button.

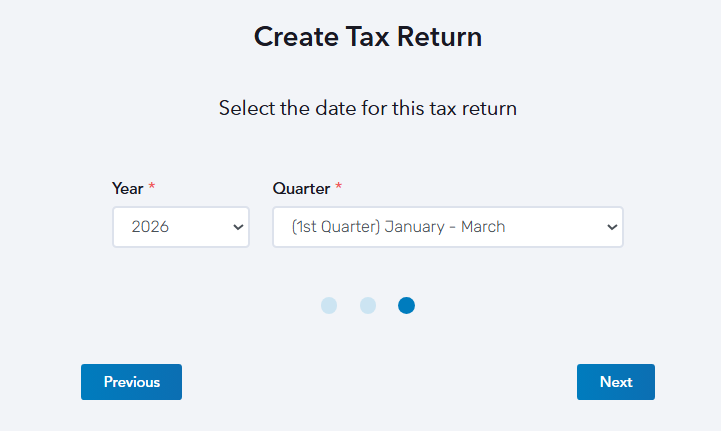

STEP 4: Select the date of the transaction covered in this report. Choose from the Year and Quarter drop-down buttons, then click Next.

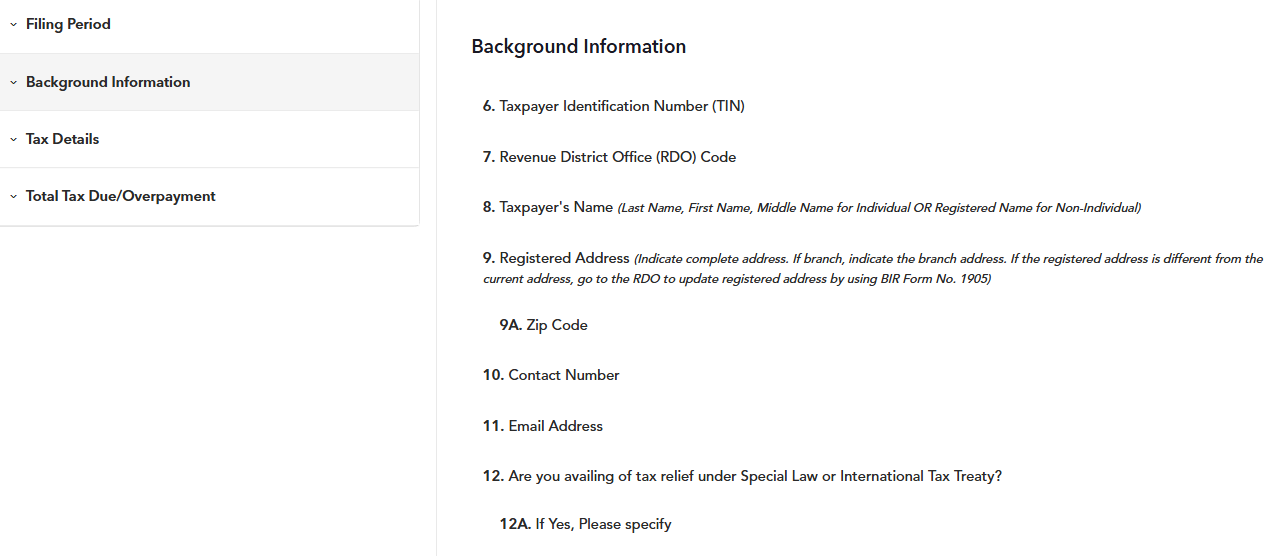

STEP 5: In the second section of the form, enter all background information properly based on your BIR Certificate of Registration (COR/Form 2303).

Certain parts of the form are already pre-populated based on the information that you have provided during the organization setup.

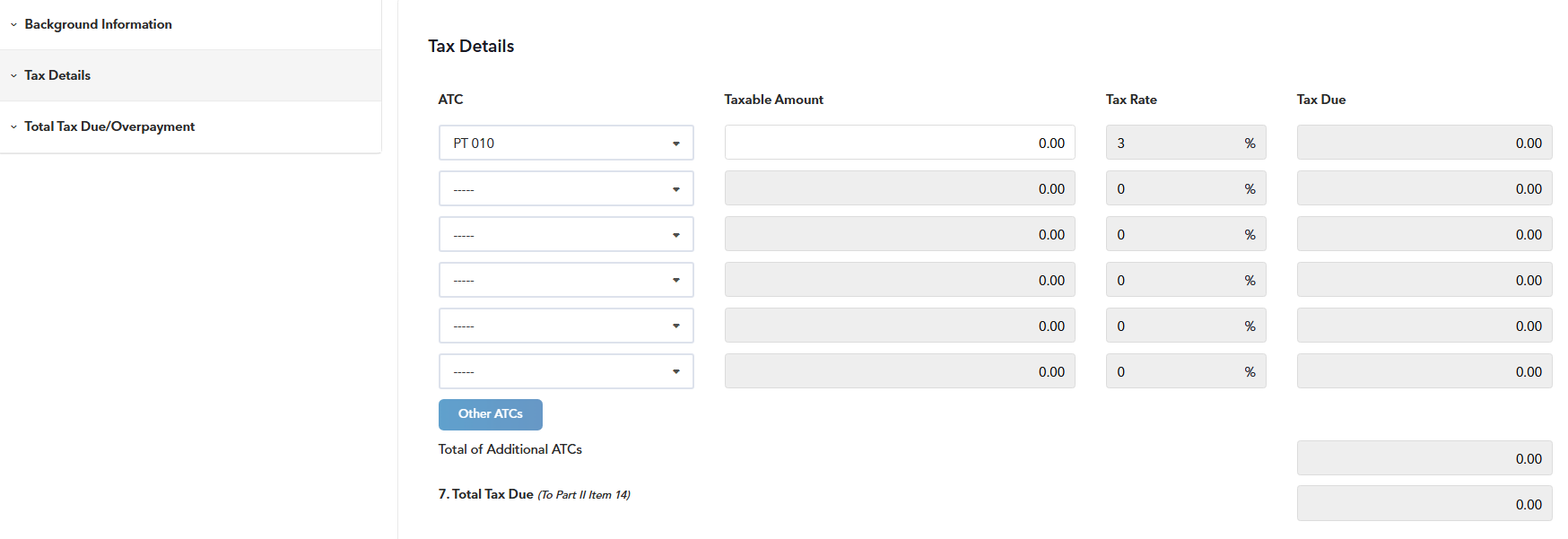

STEP 6: Start adding the details of the transaction in the Tax Details section. To understand the transaction better, you are required to enter the data in the adjacent cells inside this table such as the:

ATC (choose the correct ATC from the drop-down menu)

Taxable Amount

Tax Rate

Tax Due.

Note: Taxes are automatically computed based on the Tax Type chosen.

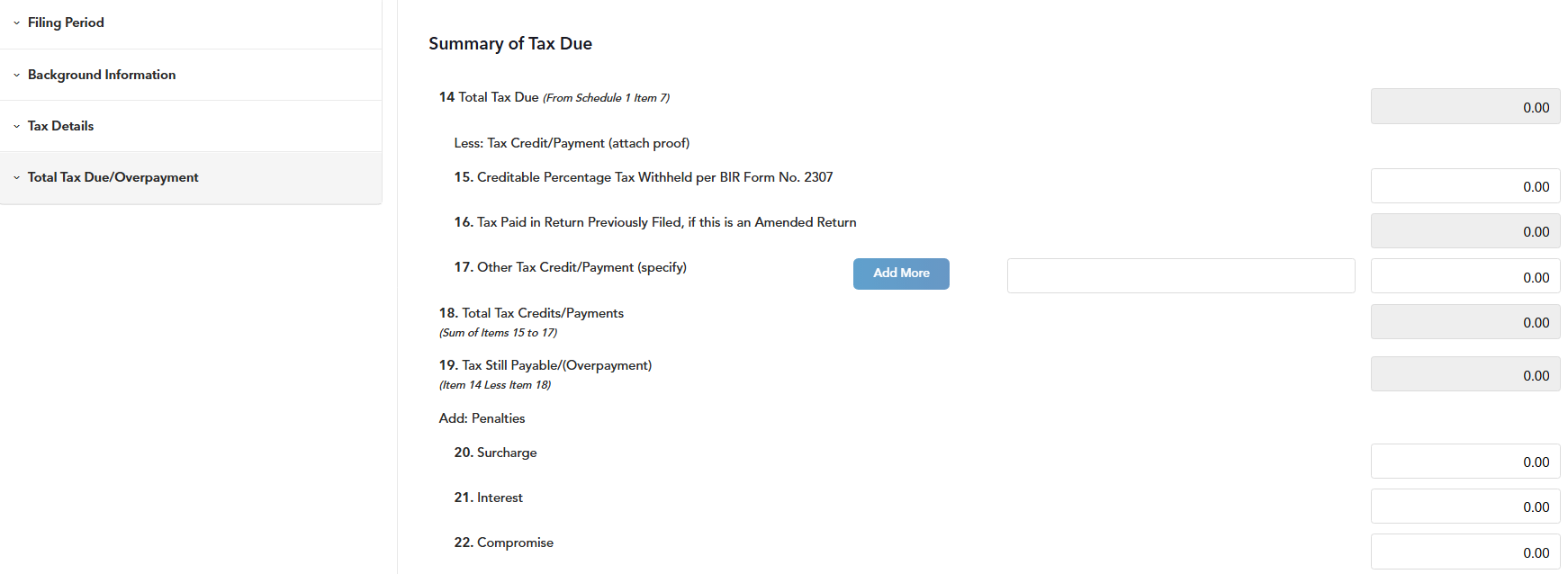

STEP 7: The last part is the Summary of Tax Due. This section will show you the list of certain items and amounts for various categories that are entered and impact your return.

Just like that! You can now proceed to the payment stage by clicking the Filing Option button located on the top-right part of the page.

Please take note that your tax forms will be sent electronically to the BIR until 9 pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

BIR Form 2551-Q is straight-out simple to fill out and complete. Get started on your tax-compliance journey today and start filing at https://juan.tax/fast-file

Helpful Links: