What is this form?

BIR Form 1701, also known as the Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts is a tax form that summarizes all the transactions made over the tax calendar year.

Who should file this form?

A resident who operates a business within (or not) the Philippines

A resident alien, or a non-resident citizen (or alien) operating a business in the Philippines

A trustee, guardian of a minor, estate administrator, or individuals acting out as an administrator on behalf of a person who's operating a business

When to file this form?

This form shall be filed and paid on or before April 15th annually, and it should cover all the incomes from the previous tax year.

How to File?

Note: If your income is tax-exempt or subject to a special or preferential rate, please use eBIR forms to file your tax return instead. Fast File is yet to support these types of items.

To file a BIR Form 1701 in Fast File, follow the steps below:

STEP 1: From your portal click on the Start Return button.

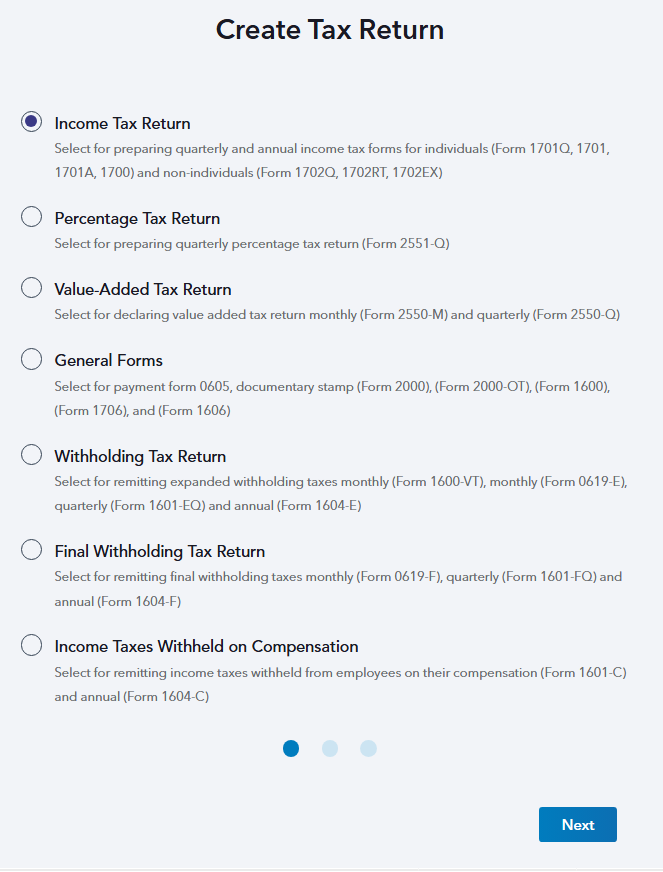

STEP 2: Select Income Tax Return and hit Next.

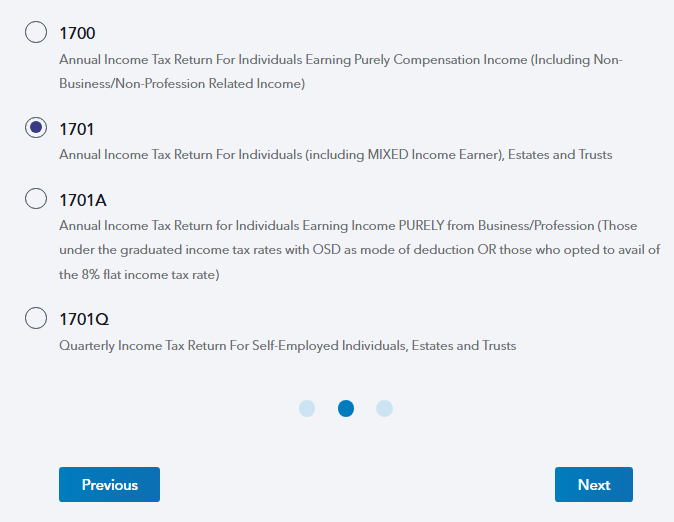

STEP 3: Choose 1701 then click the Next button.

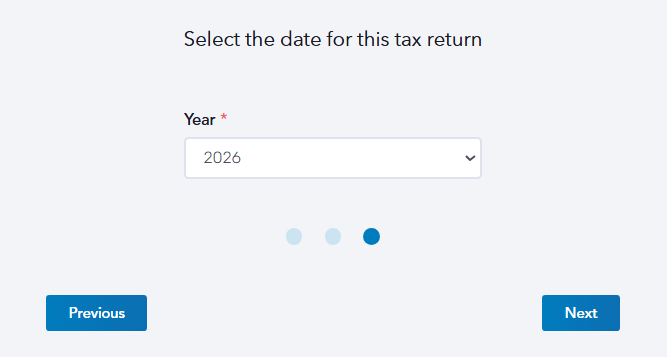

STEP 4: Select the date of the transaction covered in this report. Choose from the Year and Month drop-down list then click Next.

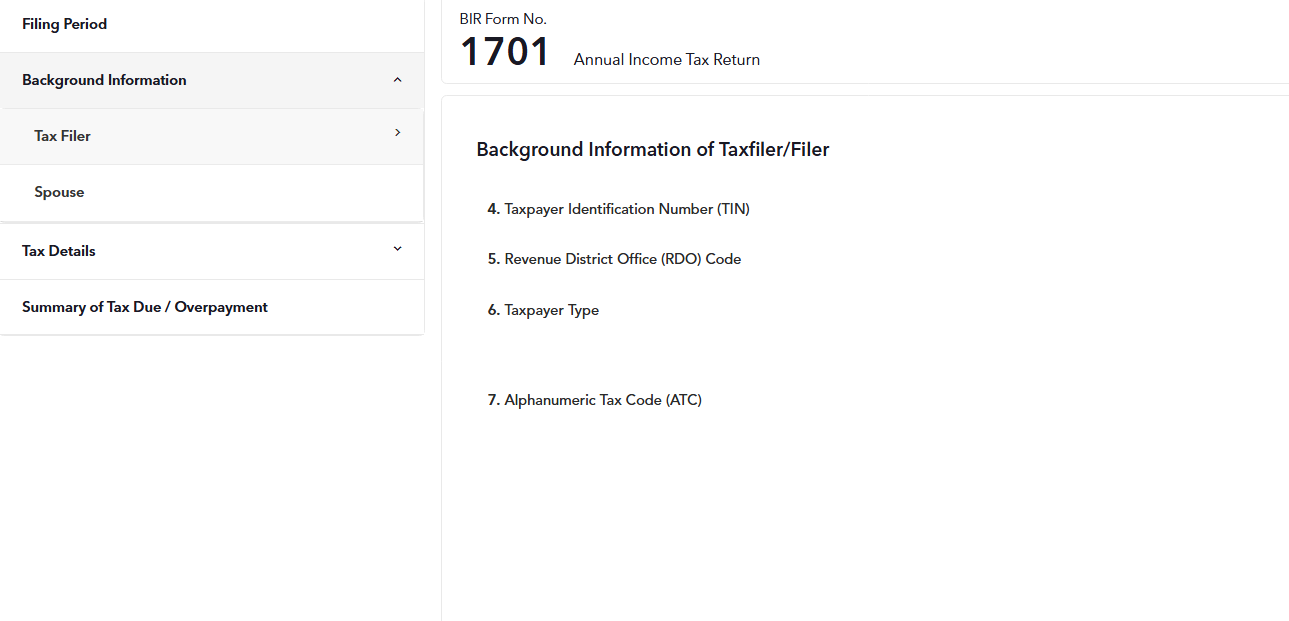

STEP 5: In the second section of the form, enter all the Tax Filer / Spouse's Background information properly based on your BIR Certificate of Registration (COR / Form 2303).

Certain parts of the form are already pre-populated based on the information that you have provided during the Organization setup.

Here are some of the important fields that you're required to fill out before proceeding to the next step:

Taxpayer Type

Single Proprietor or

Professional

Alphanumeric Tax Code (ATC)

Method of Deduction

Itemized Deduction or

Optional Standard Deduction

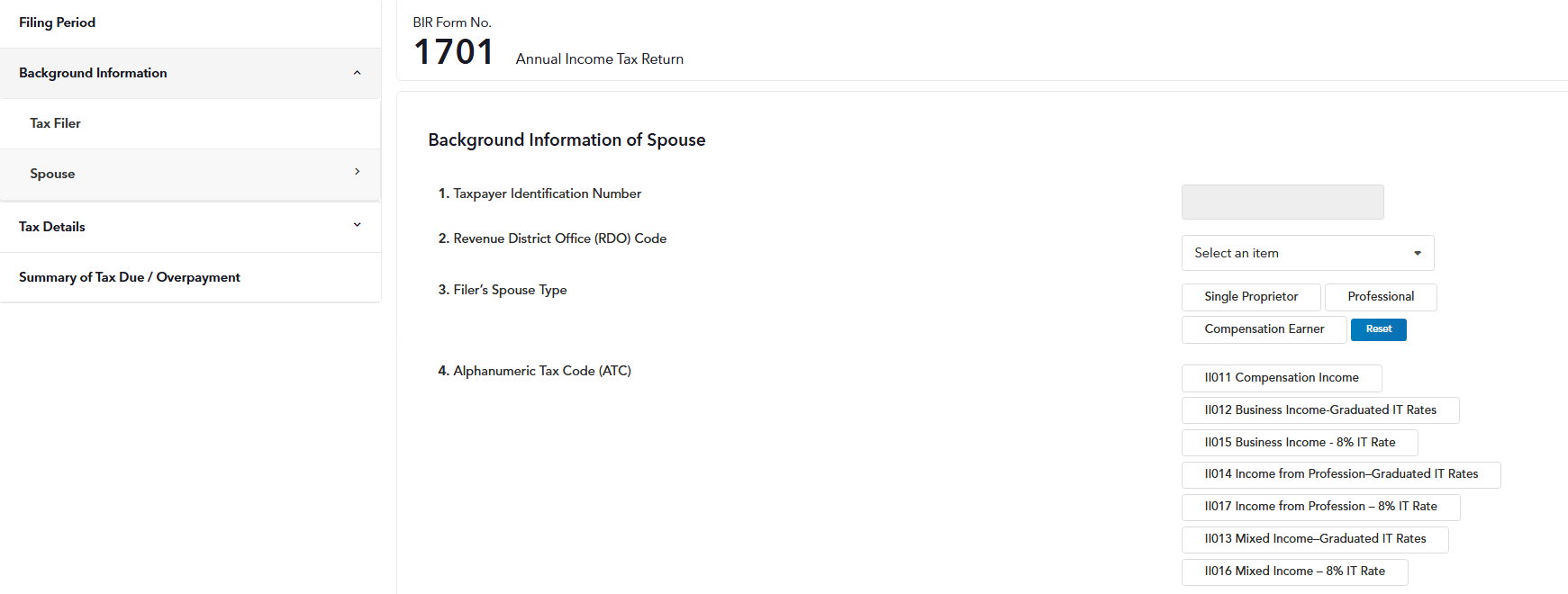

STEP 6: If you are single, you can simply skip the Background Information (Spouse) section. If you are married, fill out this part with your spouse's details.

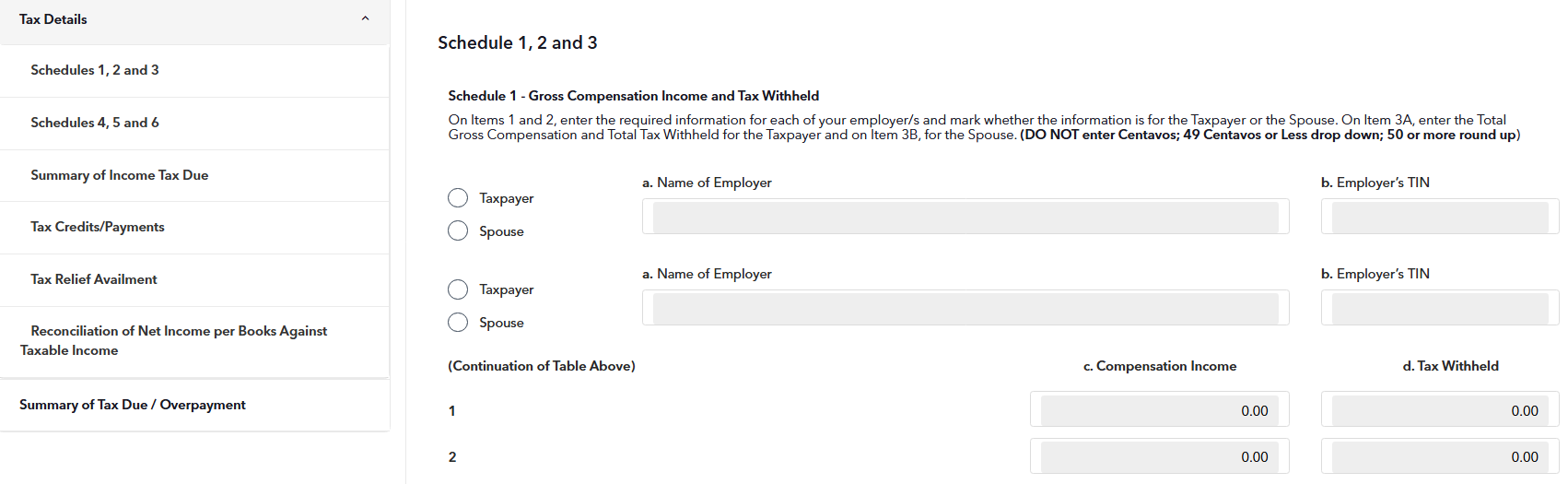

STEP 7: Fill up the Schedules with the required information and back them up with the appropriate documents:

Schedule 1 - Gross Compensation Income and Tax Withheld of tax filer and/or Spouse

Schedule 2 - for Taxable Compensation Income

Schedule 3 - for Taxable Business Income

Schedule 4 - for Ordinary Allowable Itemized Deductions

Schedule 5 - for Special Allowable Itemized Deductions

Schedule 6 - for Computation of Net Operating Loss Carry-Over (NOLCO) (applied, unapplied, and expired portion)

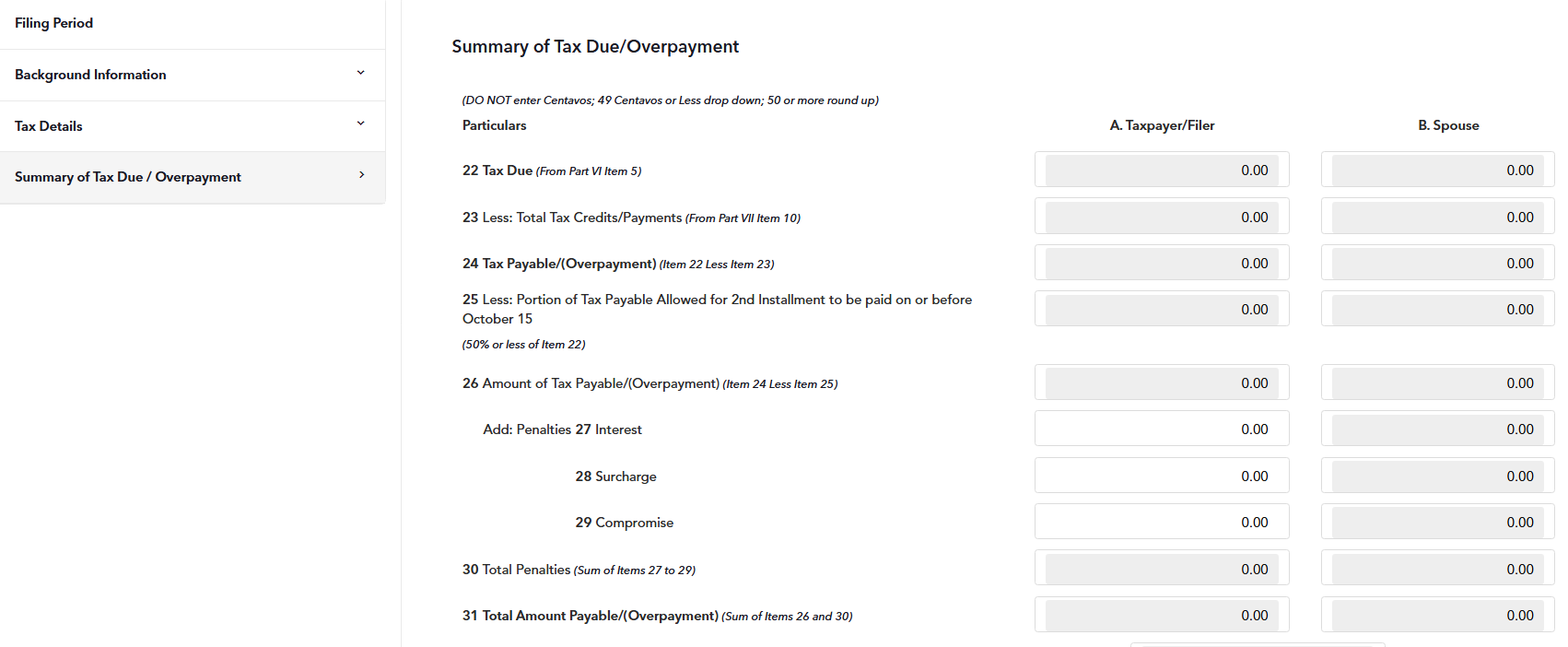

STEP 8: The Summary of Income Tax Due will show you the list of certain items and amounts for various categories that are entered and impact your return.

STEP 9 AND BELOW ARE ONLY COPIED FROM FORM 1701Q, COME BACK TO THIS TO UPDATE

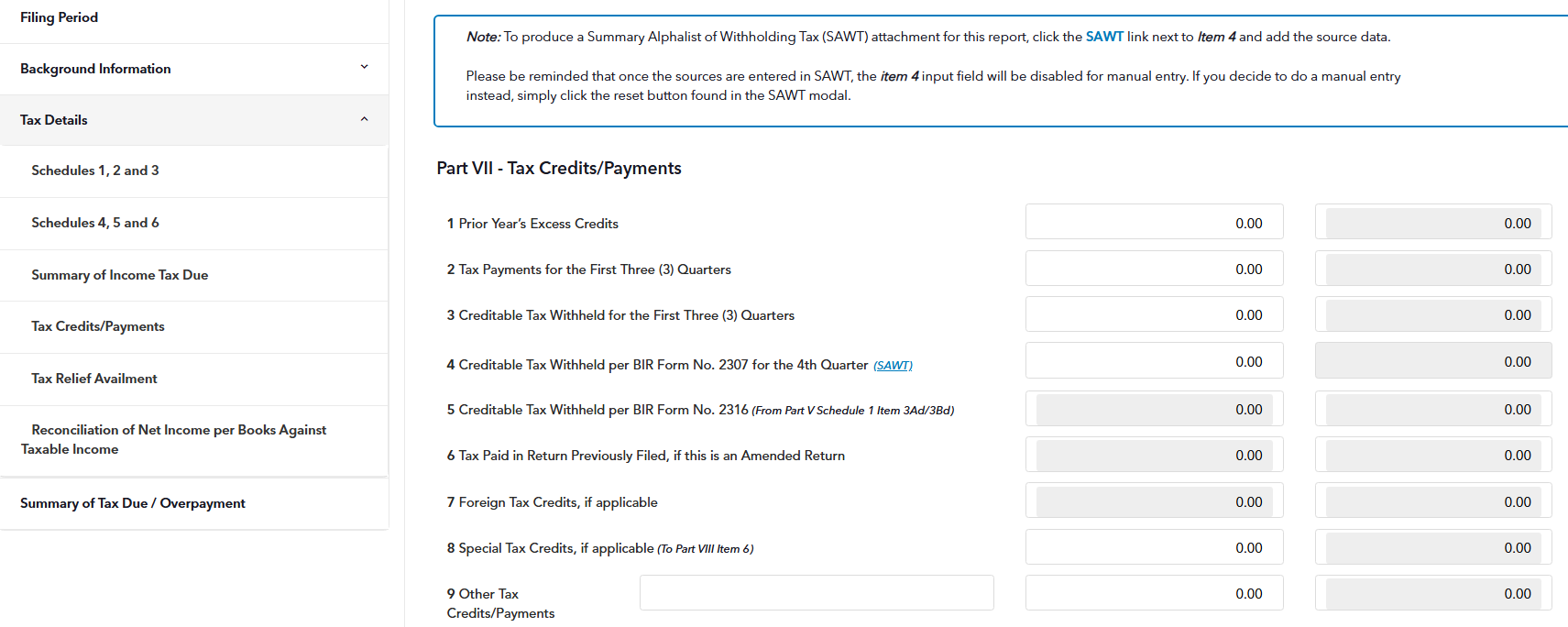

STEP 9: Enter any tax credit or tax payment you made previously.

Indicate the amounts as shown in your Audited Financial Statements. You can produce a Summary Alphalist of Withholding Tax (SAWT) attachment for this report by clicking the SAWT link next to Item 58 and add the source data.

Please be reminded that once the sources are entered in SAWT, the item 58 input field will be disabled for manual entry. If you decide to do a manual entry instead, simply click the reset button found in the SAWT modal.

Please keep in mind that filing an attachment with your BIR Form 1701 will incur an additional fee on top of the service fee per generation of forms.

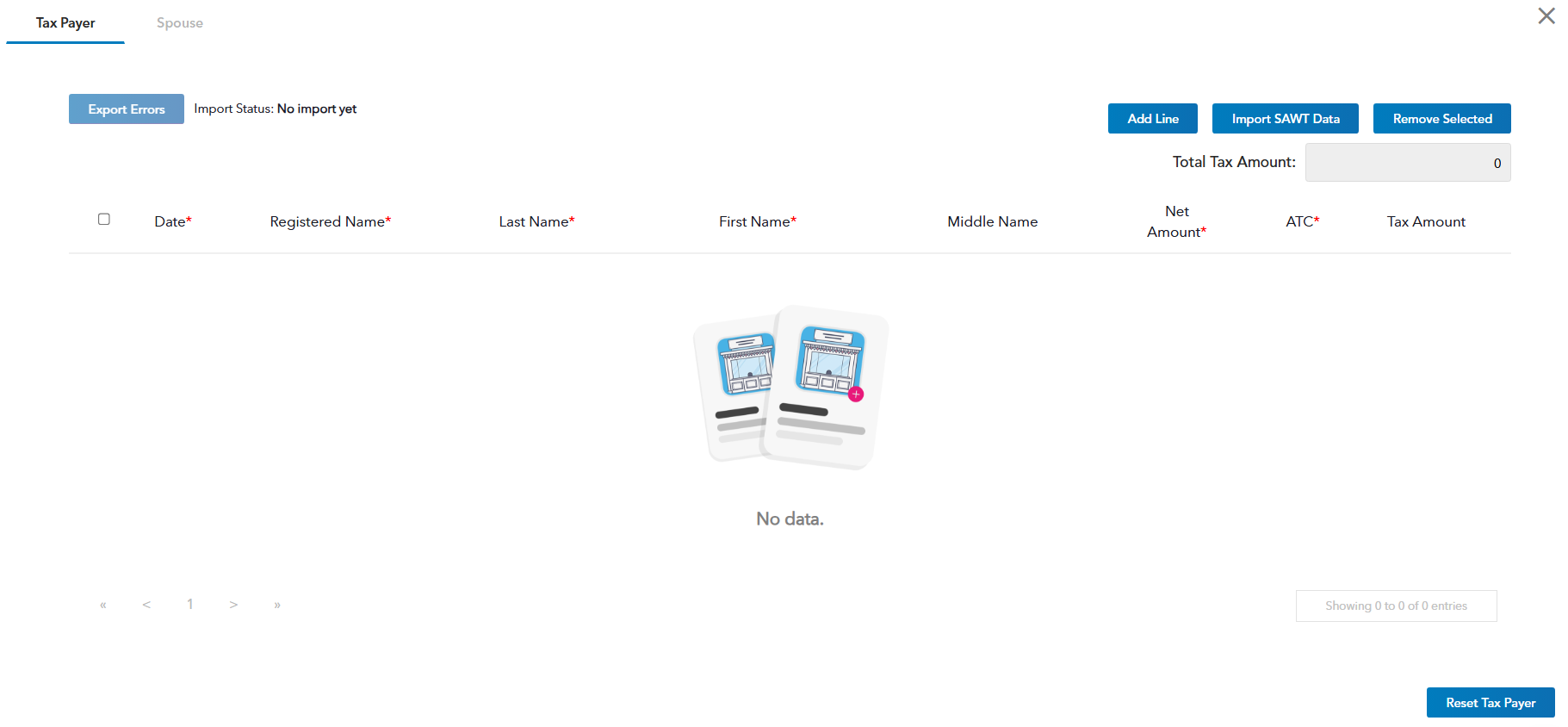

STEP 10: Once the SAWT link (beside item 58) was clicked, a modal will appear with 2 tabs where the attachments of the Tax Payer and his/her Spouse's (if applicable) can be entered.

1. Tax Payer

2. Spouse - this tab will only appear if a spouse has been declared in the Background Information section.

Here are other Schedule modal functionalities that are worth checking:

A. Import Errors - this button lets you export the errors in your CSV file, allowing you to format the data in your CSV correctly before re-importing it back to Fast File

B. Import Status - status of your import and errors in your import file will appear here

C. Add Line - this button allows users to manually add the required information, such as:

Date

Registered Name (If non-individual)

First Name

Last Name (if an individual)

Net Amount

ATC

Tax Amount

D. Import SAWT Data - click this button to start importing your SAWT file

E. Remove Selected - this button will allow you to select and delete a whole line of

data from your Schedule.

F. Reset - this allows you to remove all the data inside the modal and start afresh.

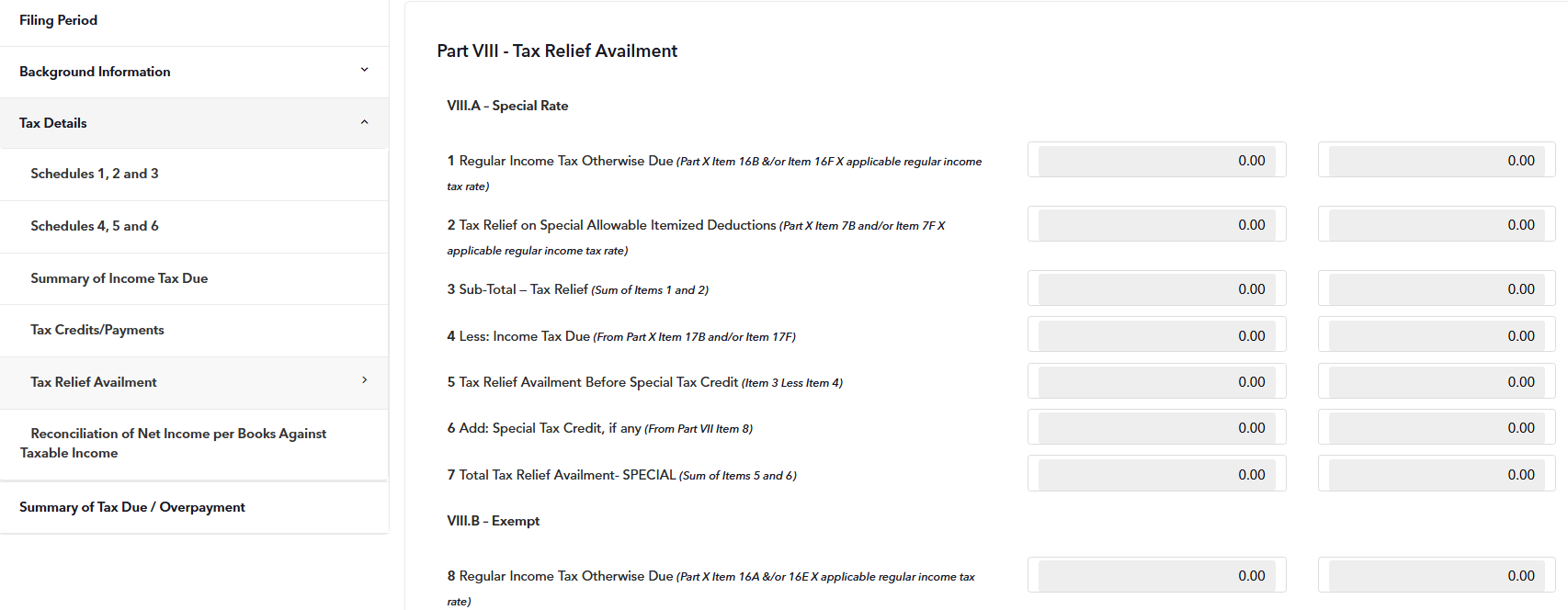

STEP 11: Taxpayers availing themselves of any tax relief under the Tax Code must fill out the Tax/Relief Availment section.

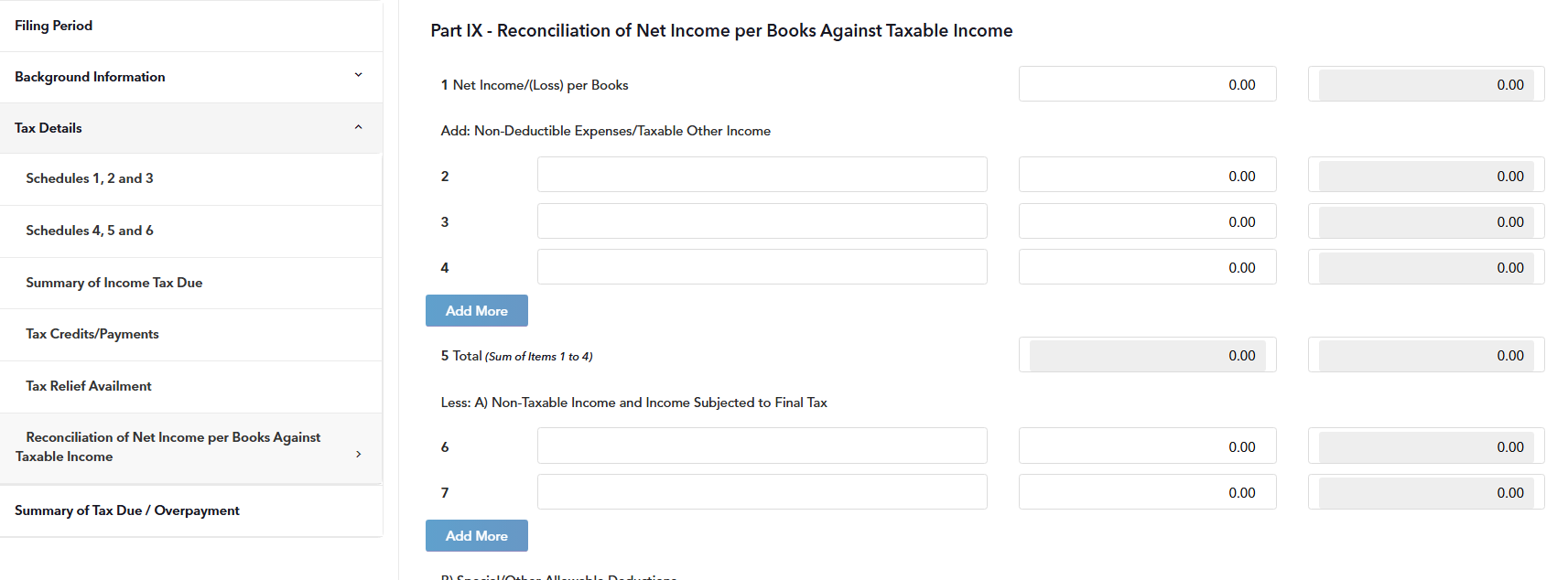

STEP 12: Enter the Tax Filer/Spouse's Reconciliation of Net Income per Books Against Taxable Income Tax.

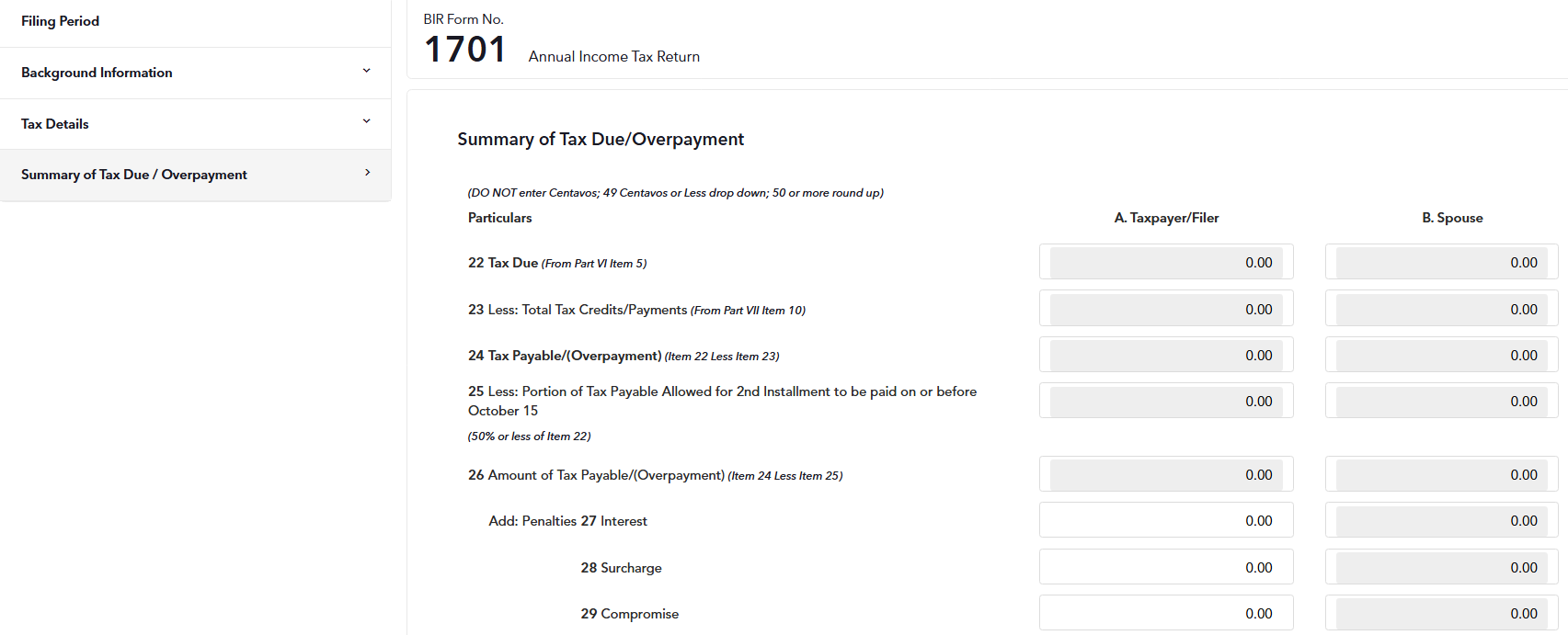

STEP 13: The Summary of Tax Due section is also pre-populated with the exact information included in your actual tax form. That is why you need to go through all of the sections to make sure you are filing an accurate return.

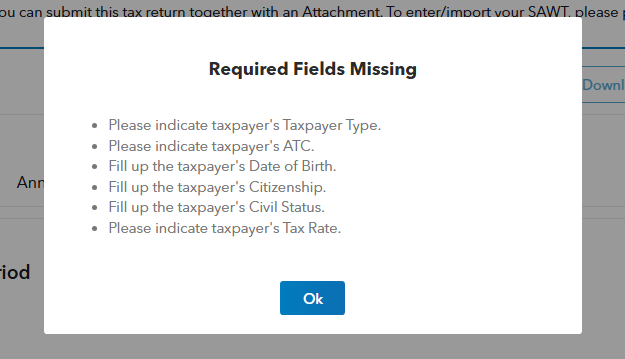

Once you're done filling up the tax form, click the Filing Options button located on the upper-right part of the page to allow the platform to determine if there are fields that have been overlooked.

Below is a sample pop-up message that will appear if a certain field hasn't been filled out properly.

STEP 11: Once all the data is validated and correct, click the Filing Options button again then check your billing charges. To proceed to the payment stage, simply click the File Now button.

Please take note that your tax forms will be sent electronically to the BIR until 9 pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

Helpful Links:

Go to Fast File - To fill out and complete your BIR Form 1701 and get started on your tax-compliance journey today

Visit Academy - For a detailed discussion on how easy it is to populate, file, and pay tax form 1701 in Fast File

Sign up here - If you don't have a JuanTax Academy account yet