What is this form?

BIR Form 1701-A, also known as the Annual Income Tax Return for Individuals Earning Income PURELY from Business or Profession (those under the graduated income tax rates with OSD as a mode of deduction OR those who opted to avail of the 8% flat income tax rate).

Who should file this form?

The return shall be filed by individuals earning income PURELY from trade/business or from the practice of a profession, to wit:

A resident citizen (within and without the Philippines);

A resident alien, non-resident citizen, or non-resident alien (within the Philippines)

The return shall only be used by said individuals as follows:

Those subject to graduated income tax rates and avail of the optional standard deduction as a method of deduction, regardless of the amount of sales/receipts and other non-operating income; OR

Those who availed of the 8% flat income tax rate whose sales/receipts and other non-operating income do not exceed P3M

When to file this form?

On or before April 15 of each year, covering income for the preceding taxable year.

How to File?

To file a BIR Form 1701-A in Fast File, follow the steps below:

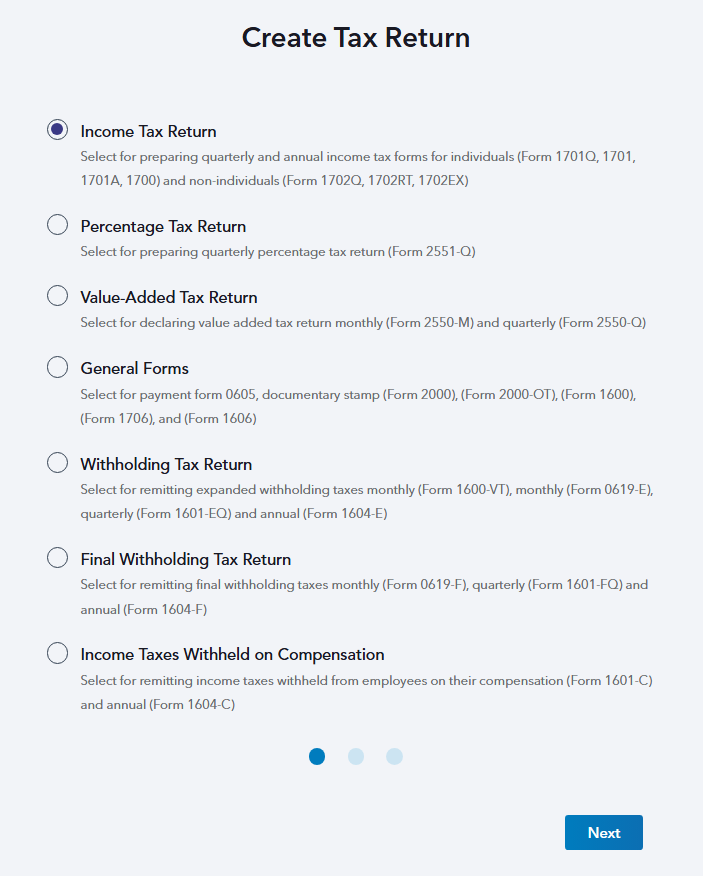

STEP 1: From your portal, click on the Start Return button.

STEP 2: Select Income Tax Return and hit Next.

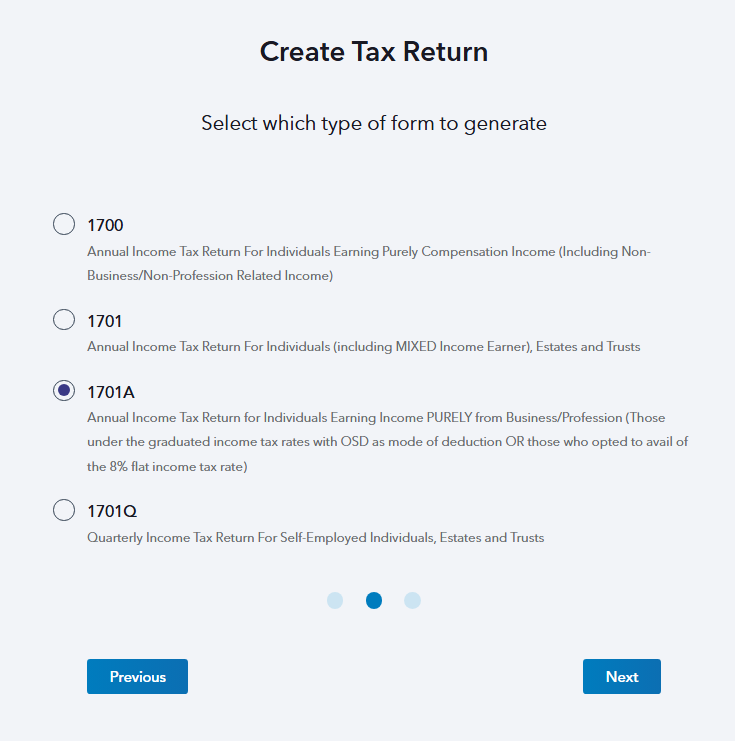

STEP 3: Choose 1701-A, then click the Next button.

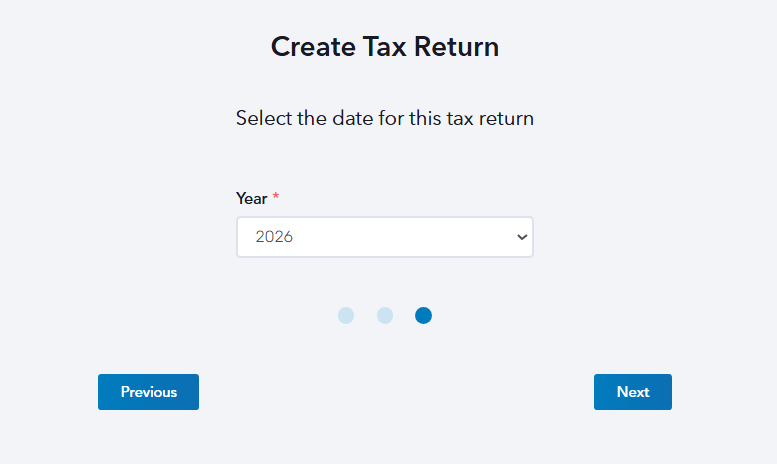

STEP 4: Select the date of the transaction covered in this report. Select the year from the drop-down menu, then press Next.

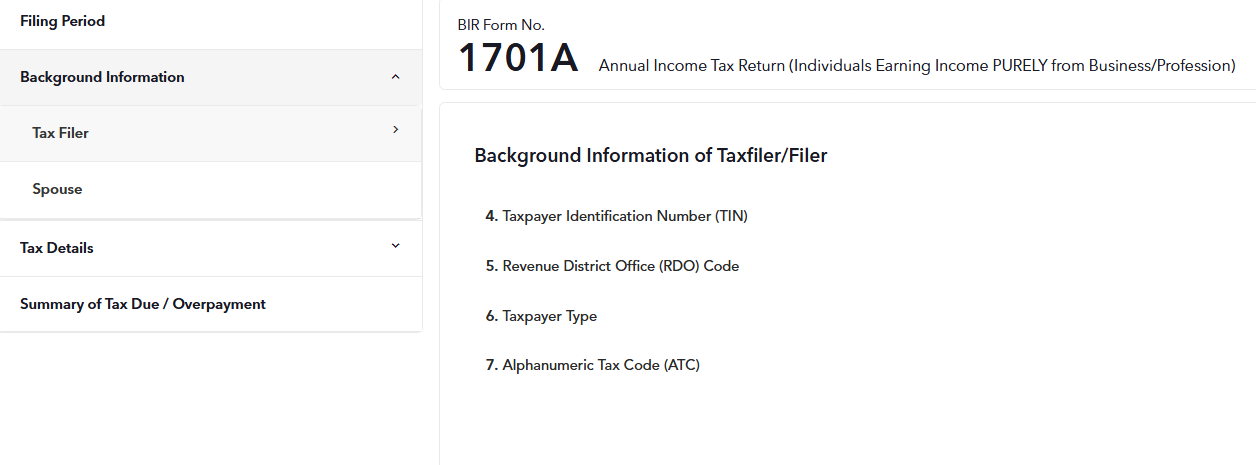

STEP 5: In the second section of the form, enter all the Tax Filer / Spouse's Background information properly based on your BIR Certificate of Registration (COR / Form 2303). Select your Taxpayer Type (either Single Proprietor or Professional) and Alphanumeric Tax Code (ATC).

Certain parts of the form are already pre-populated based on the information that you provided during the organization setup.

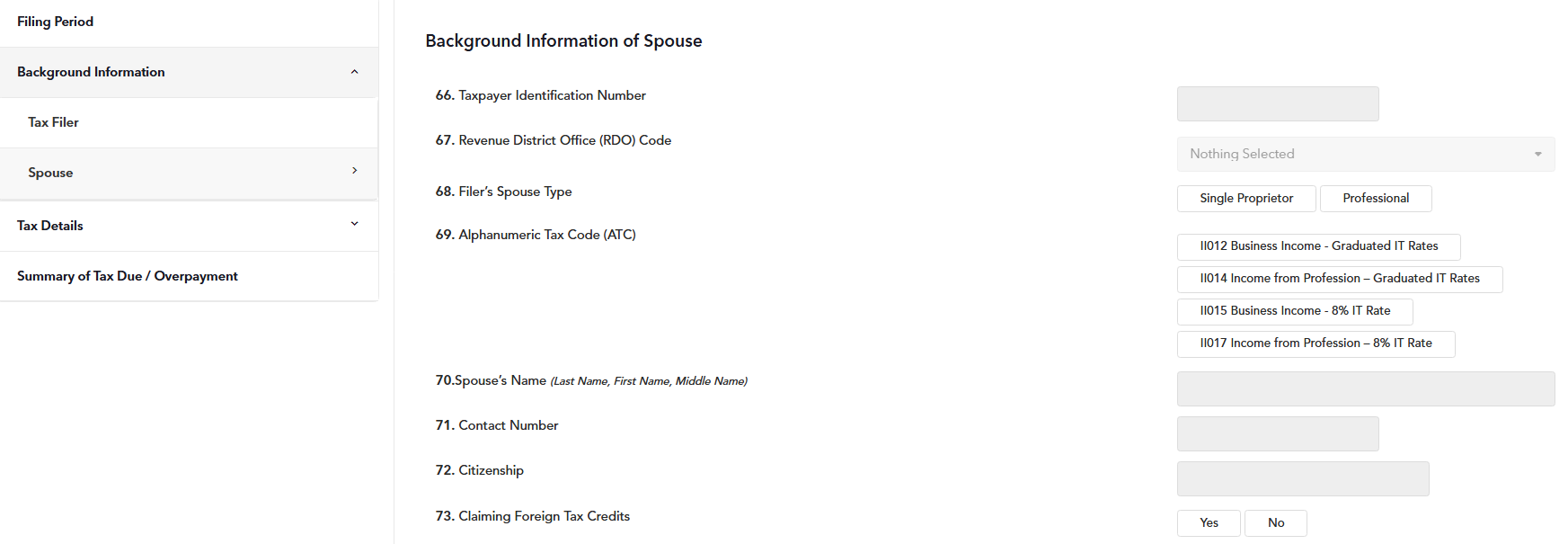

STEP 6: If you are single, you can skip the Background Information (Spouse) section. If you are married, fill out this part with your spouse's details.

STEP 7: Proceed to the Tax Details section for the computation of your income tax associated with the tax rate you have chosen (OSD or 8%).

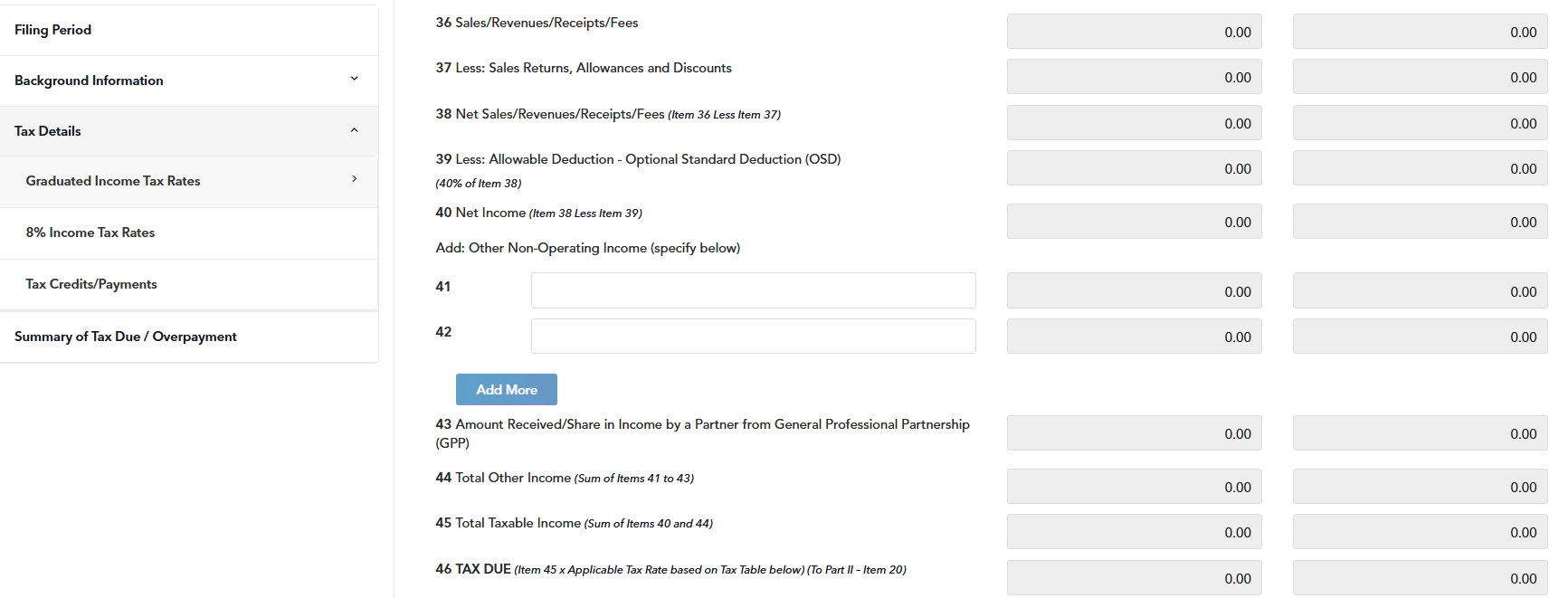

A. Fill in items 36 to 46 if you availed of the Optional Standard Deductions (OSD);

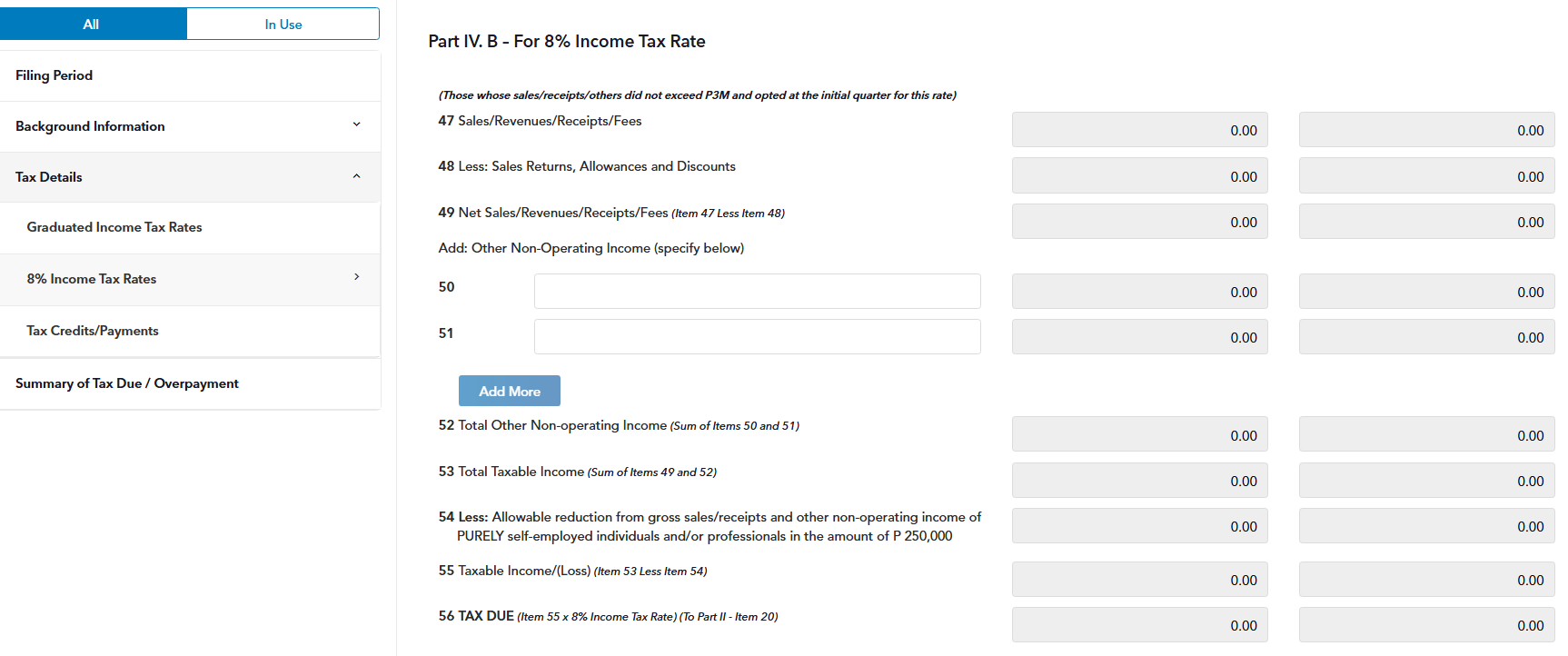

B. Fill in items 47 to 56 if you availed of the 8% flat income tax rate or whose sales receipts and other non-operating income DO NOT exceed 3 million pesos.

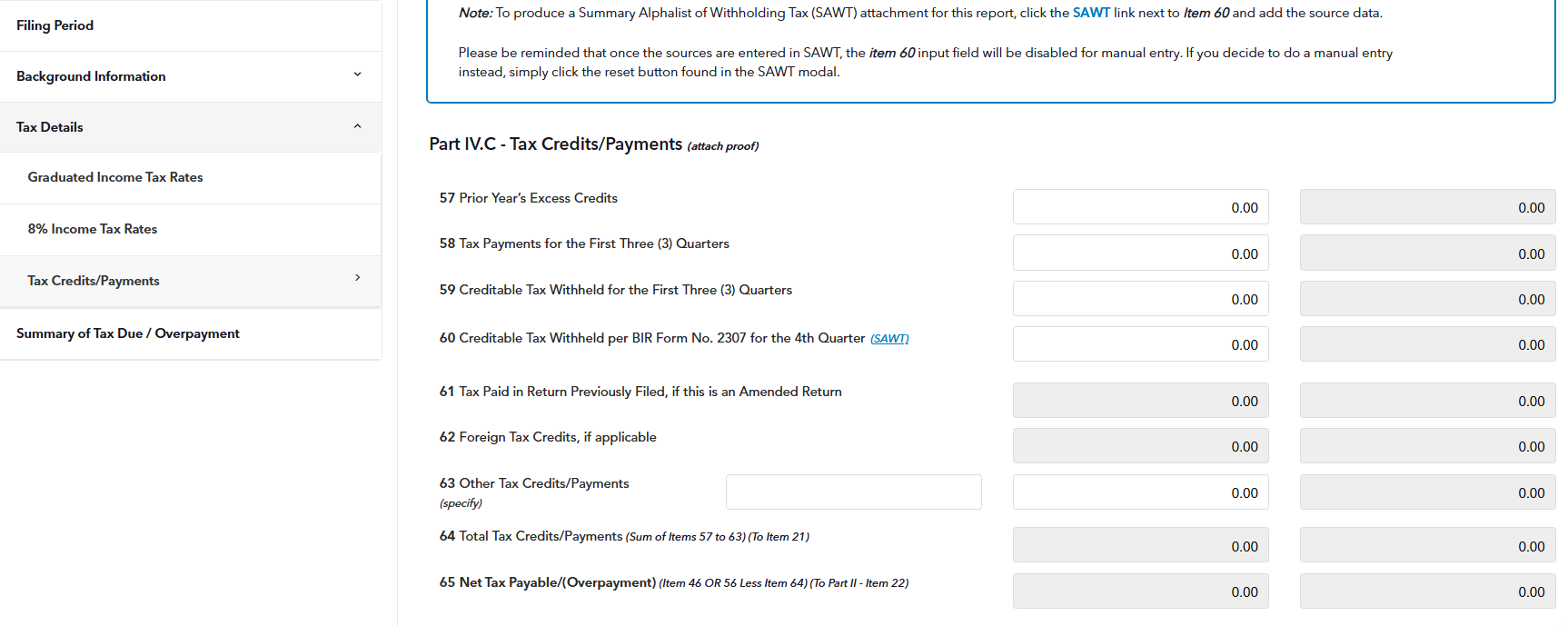

C. Enter any tax credits or tax payments you made previously.

Indicate the amounts as shown in your Audited Financial Statements. You can produce a Summary Alphalist of Withholding Tax (SAWT) attachment for this report by clicking the SAWT link next to Item 60 and add the source data.

Please be reminded that once the sources are entered in SAWT, the item 60 input field will be disabled for manual entry. If you decide to do a manual entry instead, simply click the reset button found in the SAWT modal.

Please keep in mind that filing an attachment with your BIR Form 1701-A will incur an additional fee on top of the service fee per generation of forms.

Forms that are filed with zero or negative tax due payable are free of charge in Fast File.

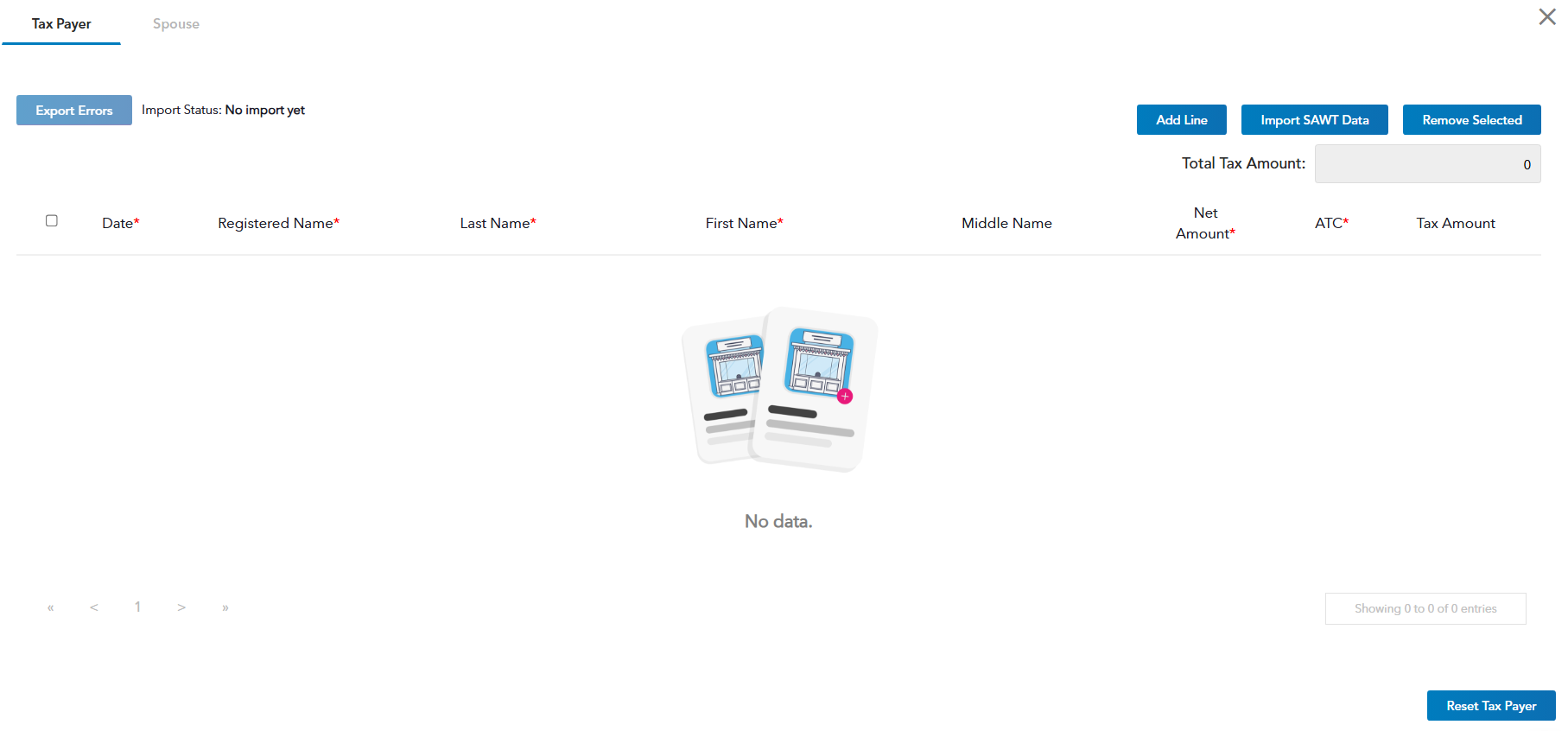

STEP 8: Once the SAWT link (beside item 60) is clicked, a modal will appear with 2 tabs where the attachments of the Tax Payer and his/her Spouse (if applicable) can be entered.

1. Tax Payer

2. Spouse - this tab will only appear if a spouse has been declared in the Background Information section.

Here are other Schedule modal functionalities that are worth checking:

A. Import Errors - this button lets you export the errors in your CSV file, allowing you to format the data in your CSV correctly before re-importing it back to Fast File

B. Import Status - status of your import and errors in your import file will appear here

C. Add Line - this button allows users to manually add the required information such as:

Date

Registered Name (If non-individual)

First Name

Last Name (if an individual)

Net Amount

ATC

Tax Amount

D. Import SAWT Data - click this button to start importing your SAWT file

E. Remove Selected - this button will allow you to select and delete a whole line of

data from your Schedule.

F. Total Tax Amount - Displays the total tax amount based on the numbers you entered in the modal.

G. Reset Taxpayer- this allows you to remove all the data inside the modal and start afresh.

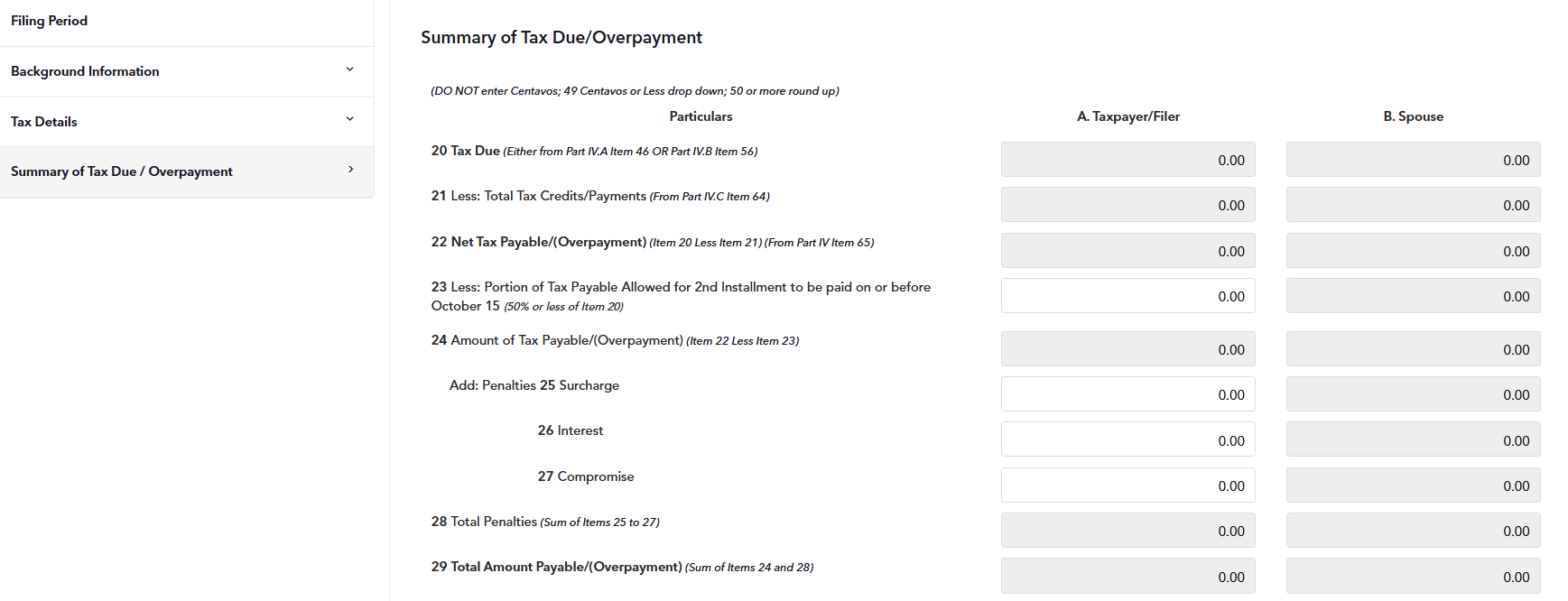

STEP 9: The Summary of Tax Due section is also pre-populated with the exact information included in your actual tax form. That is why you need to go through all of the sections to make sure you that are filing an accurate return.

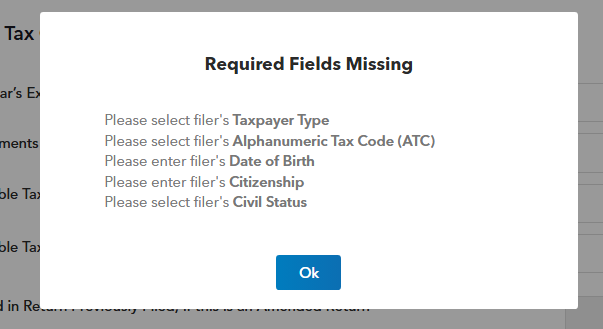

Once you're done filling up the tax form, click the Filing Options button located on the upper-right part of the page to allow the platform to determine if there are fields that have been overlooked.

Below is a sample pop-up message that will appear if a certain field hasn't been filled out properly.

STEP 10: Once all the data is validated and correct, click the Filing Options button again then check your billing charges. To proceed to the payment stage, simply click the File Now button.

Please take note that your tax forms will be sent electronically to the BIR until 9 pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

Helpful Links:

Go to Fast File - To fill out and complete your BIR Form 1701-A and get started on your tax-compliance journey today

Visit Academy - For a detailed discussion on how easy it is to populate, file, and pay tax form 1701-A in Fast File

Sign up here - If you don't have a JuanTax Academy account yet