What is it?

Form 1601-C, or Monthly Remittance Return of Income Taxes Withheld on Compensation, is filed by employers when they withhold or remove the applicable withholding tax before making salary payments to their employees.

Who needs to file it?

Withholding agents and employers who deduct and withhold taxes on compensation paid to employees.

When do you file it?

For the months of January to November – on or before the 10th day of the following month.

For the month of December – on or before the 15th day of the following month.

What you need to know:

It is the responsibility of the Withholding Agent/Employer to remit their Employee's income in a form of compensation if they are qualified for substituted filing.

Not all employees are subject to withholding tax under the TRAIN LAW. Minimum wage earners are exempted from income tax and consequently from withholding tax. Those whose annual income does not exceed P250,000 are also not subject to withholding tax.

But even then, employers must still file a BIR Form No. 1601-C to report to the BIR that they have employees. The amounts Withholding agents/employers pay to their employees are the figures presented in the BIR Form 1601-C, hence a deductible expense for income tax purposes.

How to File?

To file a BIR Form 1601-C in Fast File, follow the steps below:

STEP 1: From your portal, click on the Start Return button.

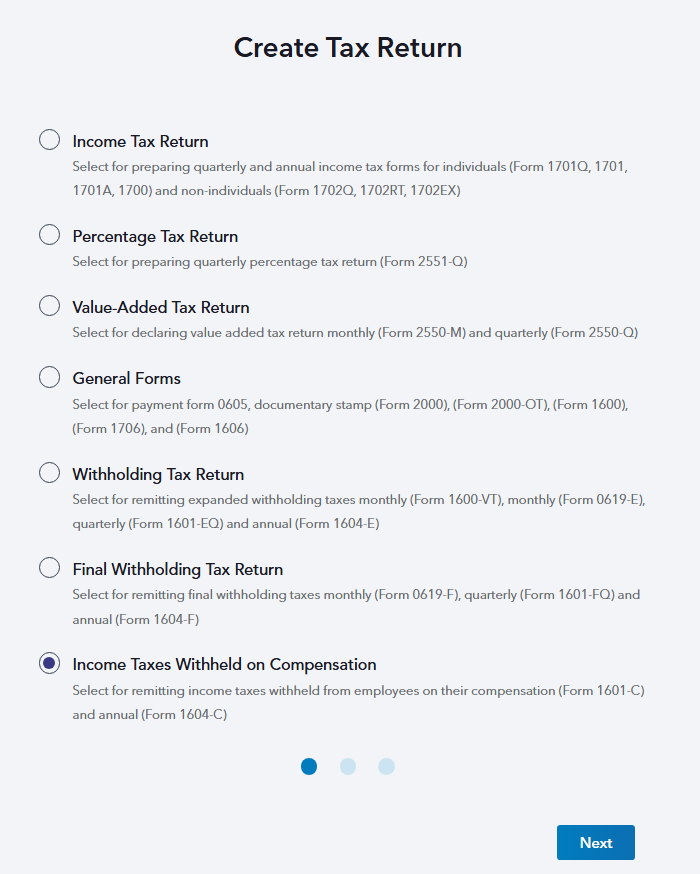

STEP 2: Select Income Taxes Withheld on Compensation and hit Next.

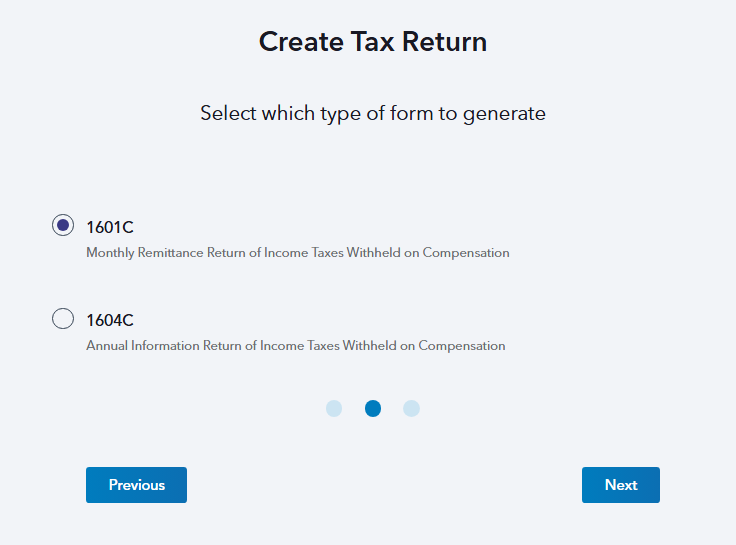

STEP 3: Since 1601C is automatically selected, just click the Next button to proceed to the next step.

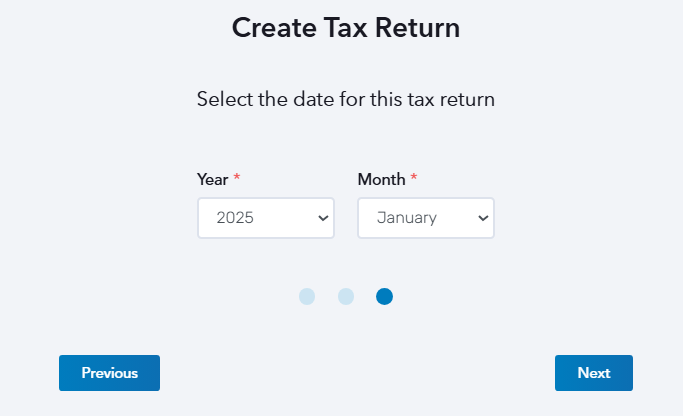

STEP 4: Select the date of the transaction covered in this report. Choose from the Year and Month drop-down buttons, then click Next.

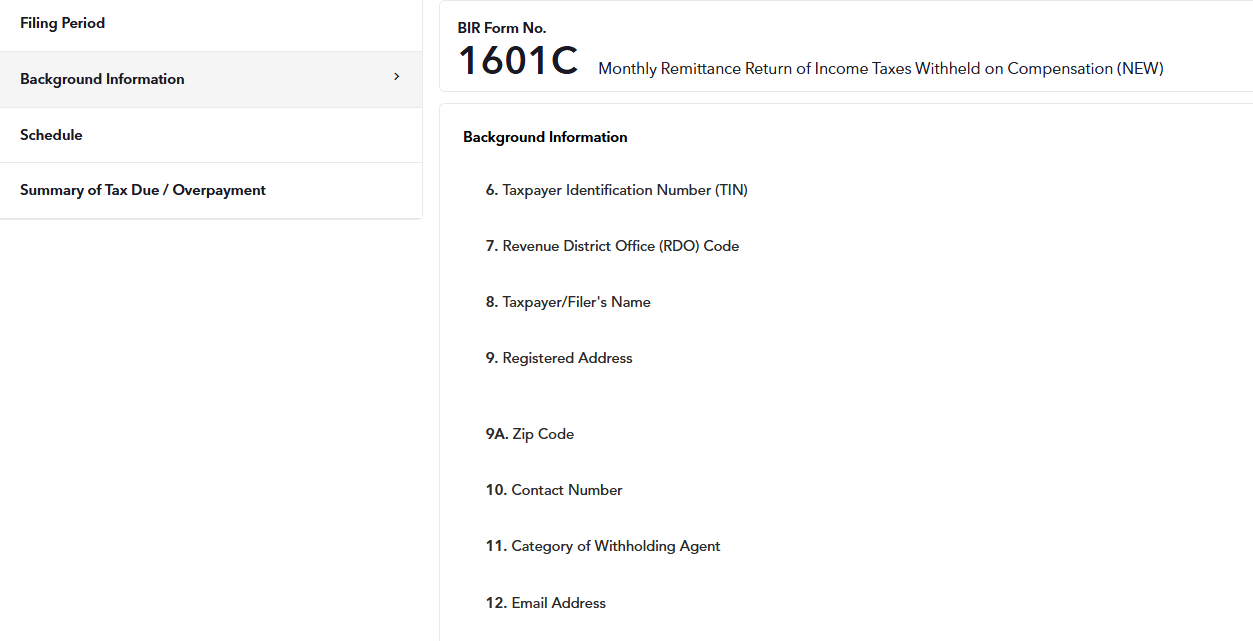

STEP 5: In the second section of the form, enter all your (as a Withholding Agent) Background information properly and exactly the same as what's on your BIR Certificate of Registration (COR / Form 2303).

Certain parts of the form are already pre-populated based on the information that you have provided during the Organization setup.

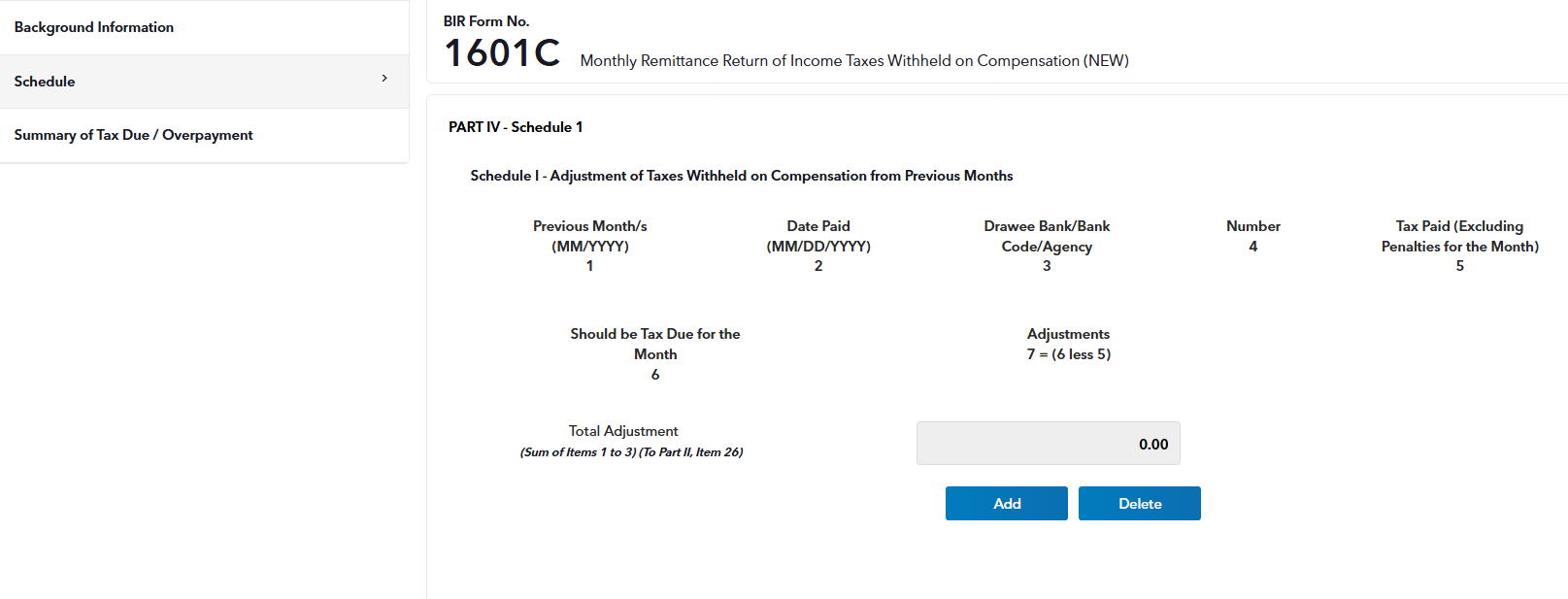

STEP 6: In Schedule 1, enter the Adjustment of Taxes Withheld on Compensation from Previous Months. This includes the following details:

Previous Month/s (MM/YYYY)

Date Paid (MM/DD/YYYY)

Drawee Bank/Bank Code/Agency

Number

Tax Paid (Excluding Penalties for the Month)

Should be Tax Due for the Month

Adjustments

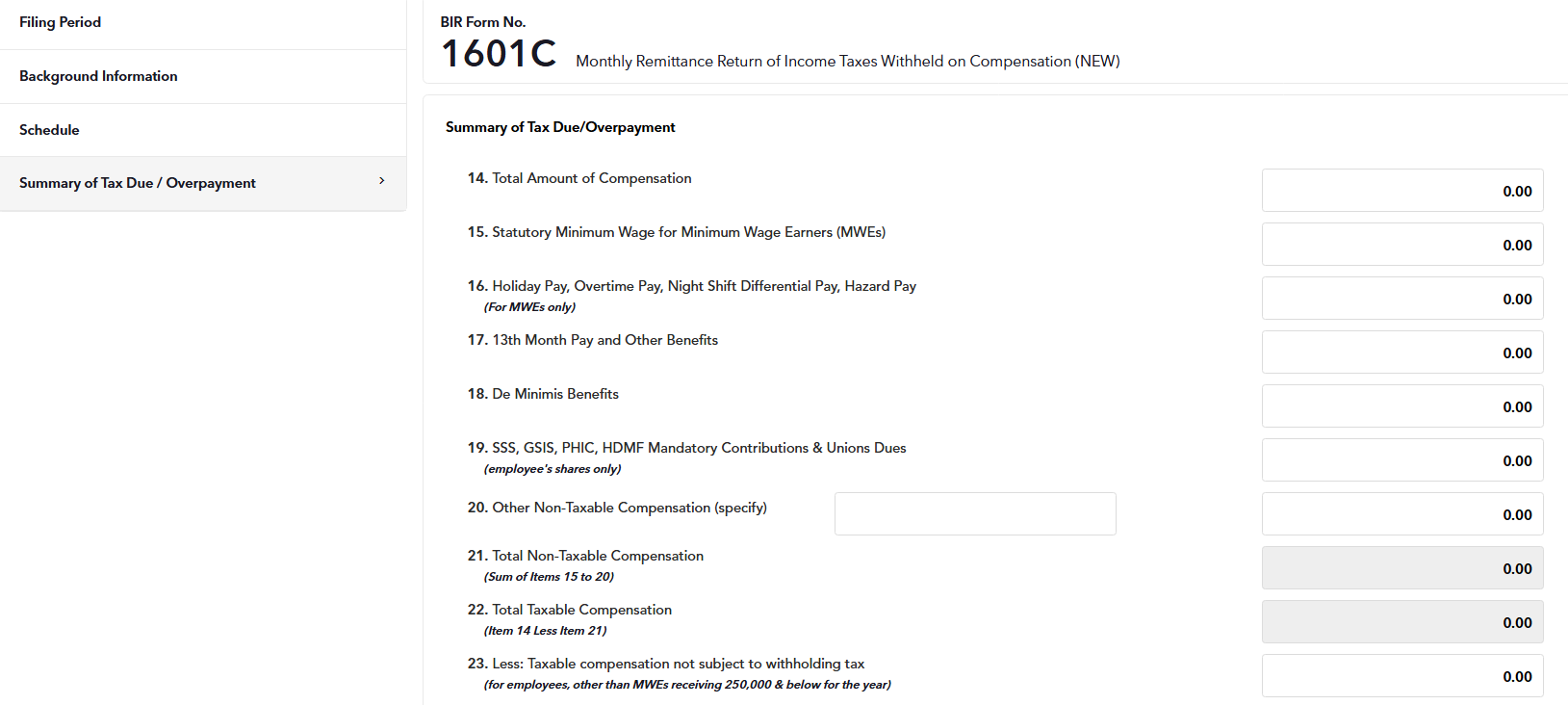

STEP 7: In the final section, Summary of Tax Due/Overpayment, to get the TOTAL AMOUNT STILL DUE/Over Remittance, get the sum of Tax Still Due/(Over-remittance) and Penalties (items 31 and 35).

That's it! You can now proceed to the payment stage by clicking the Filing Options button located on the top-right part of the page.

Please take note that your tax forms will be sent electronically to the BIR until 9 pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

BIR Form 1601-C is straight-out simple to fill out and complete. Get started on your tax-compliance journey today and start filing at https://juan.tax/fast-file

Helpful Links: