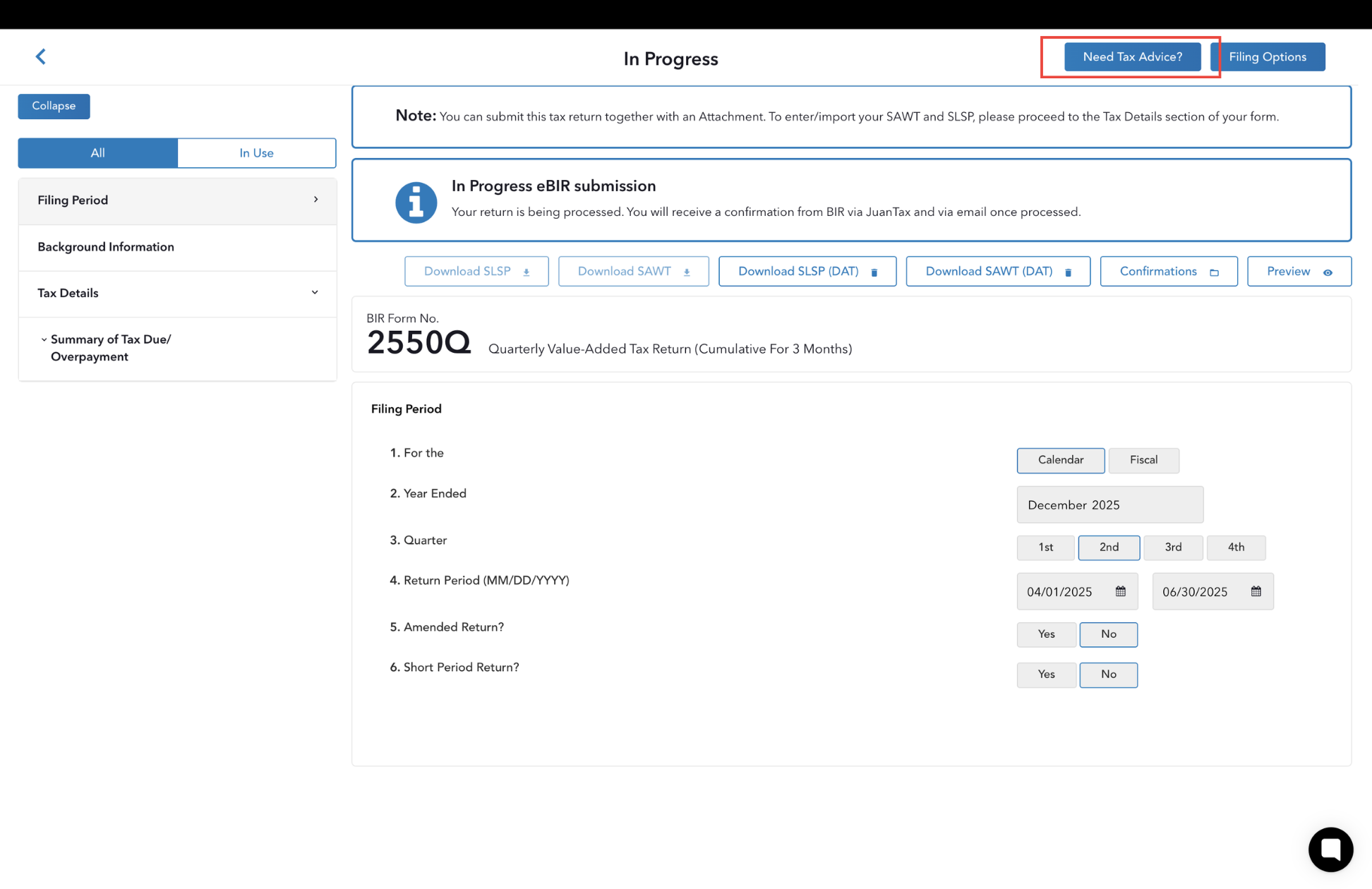

STEP 1: There is an option inside every generated tax form in Fast File for those who might need accounting or tax advisory services. To access this, simply click the button next to the blue Need Tax Advice? text.

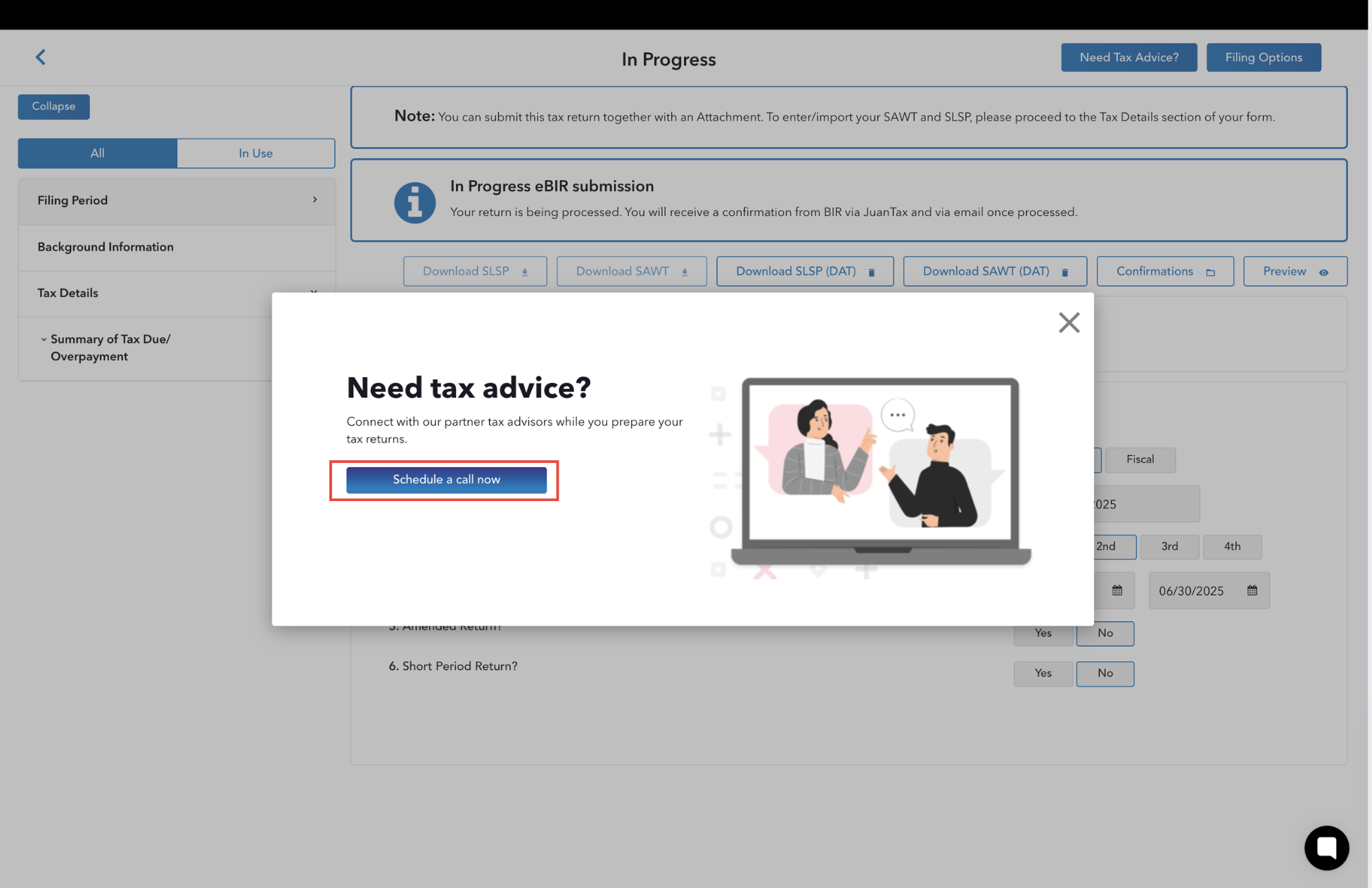

STEP 2: Click the Schedule a call now button.

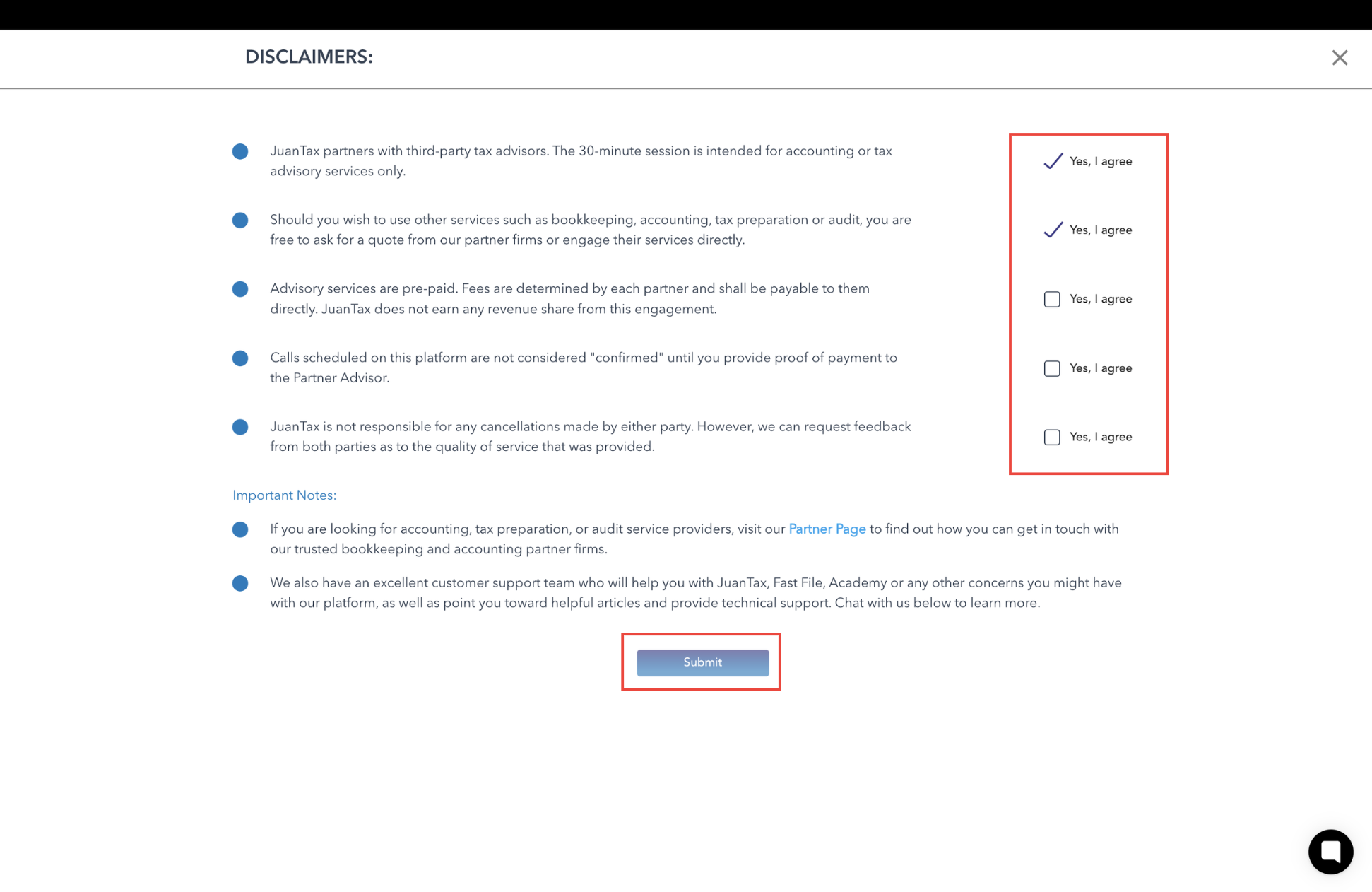

STEP 3: Please read the disclaimers carefully, and if you agree, place a checkmark on the tick boxes. Finish off by clicking the Submit button.

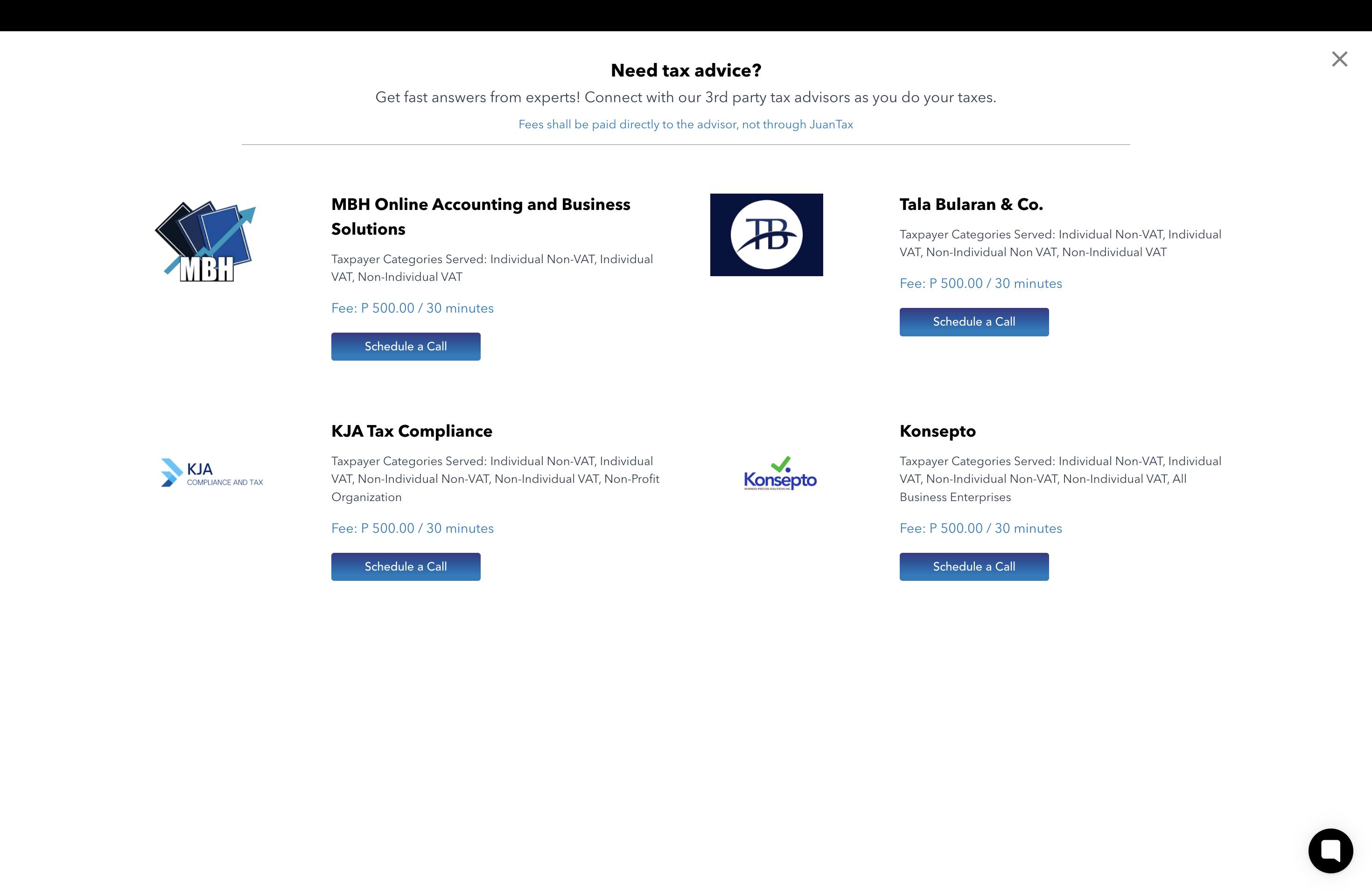

STEP 4: Choose from our list of trusted partner firms and click the Schedule a Call button.

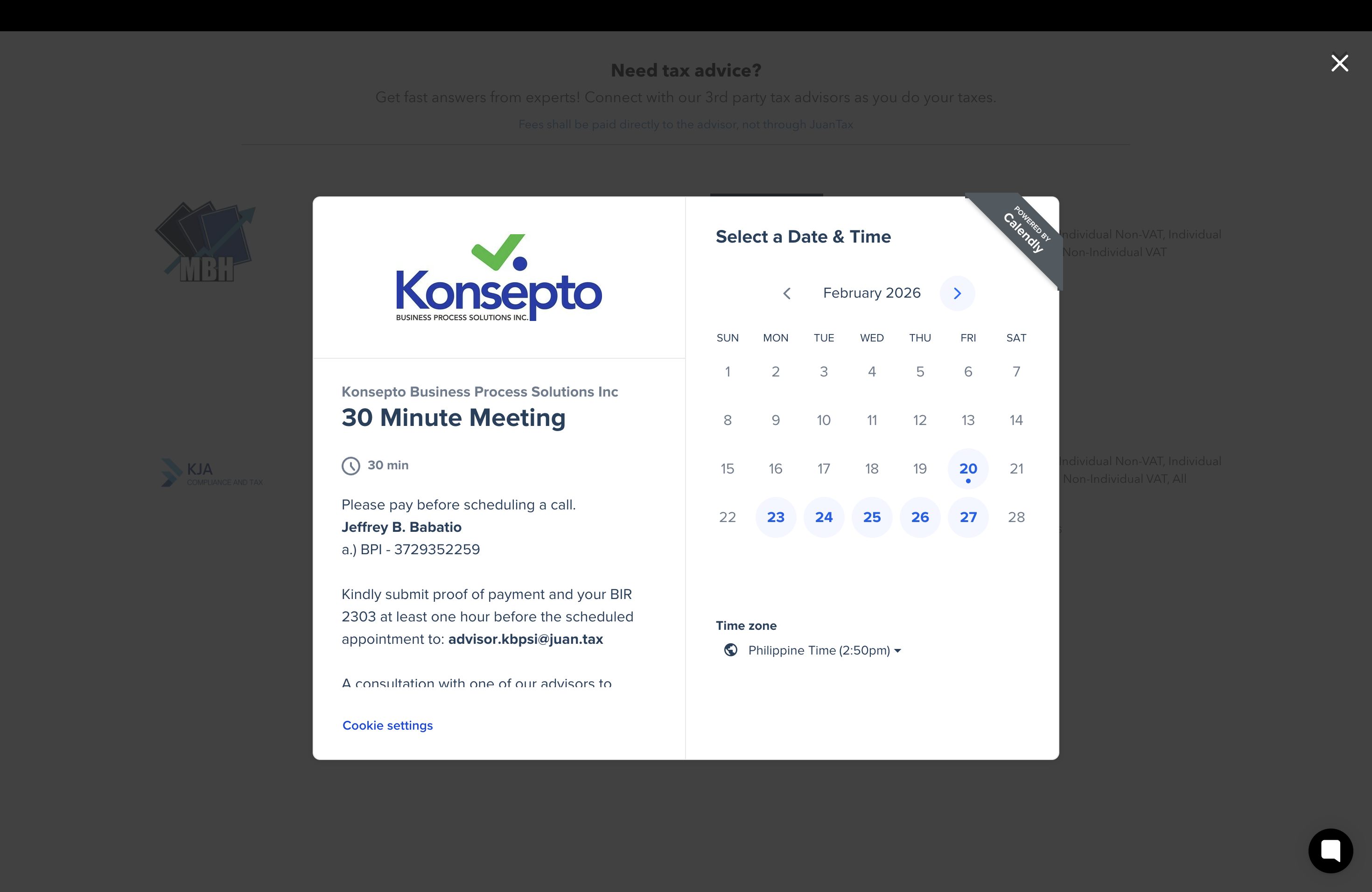

STEP 5: This will re-route you to the Partner’s Calendly link.

Friendly Reminder: Please pay before scheduling a call. You can find the partner's payment details and email address on the left-hand side of Calendly.

STEP 6: Select an available date & time.

Note: Please submit your proof of payment at least two hours before your appointment call.

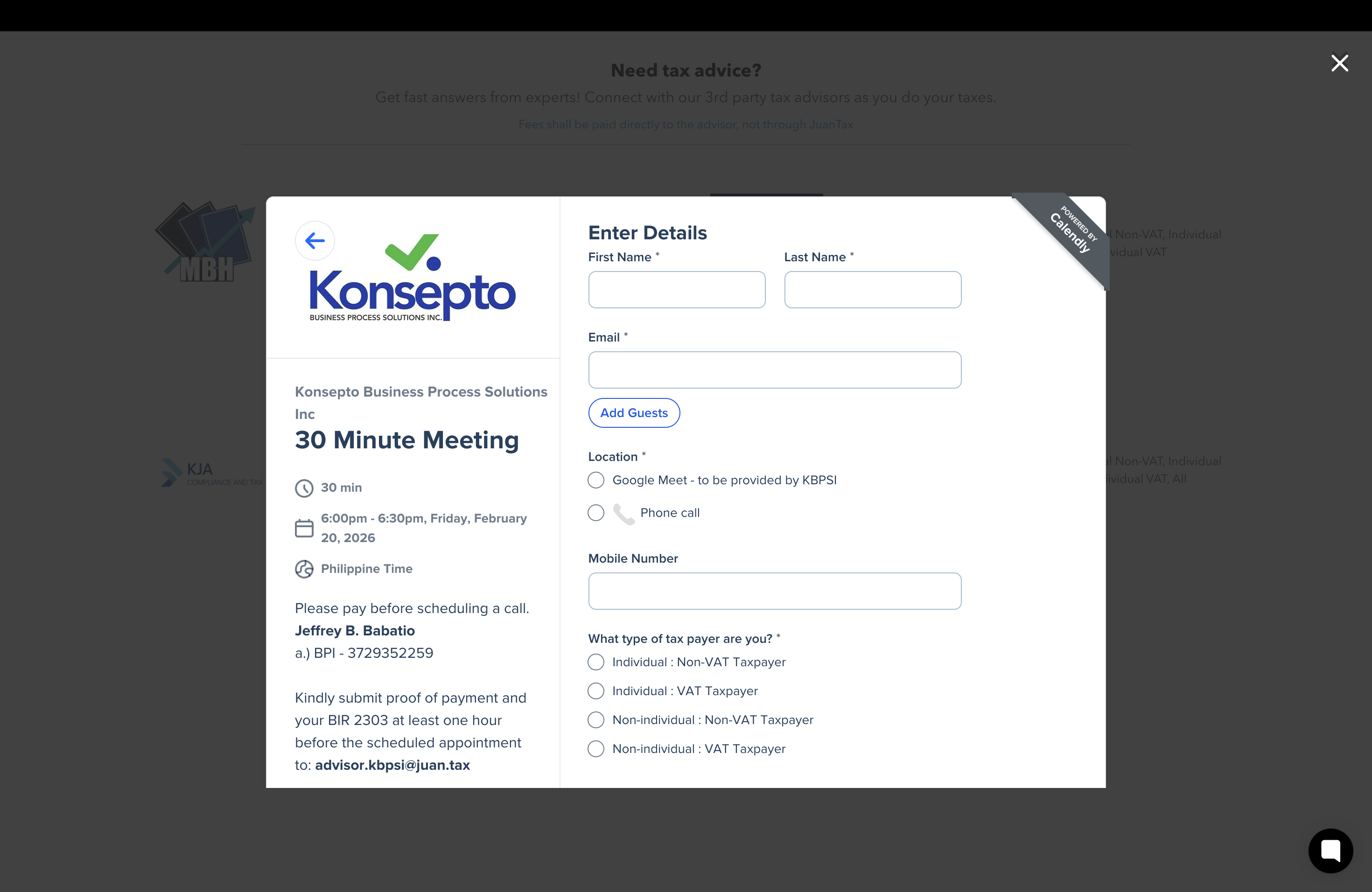

STEP 7: Complete all the required details, such as:

Complete Name

Email,

Guests (if applicable)

Location (this is where you prefer to meet—Google Meet or Phone Call)

Mobile Number

Taxpayer Type

Brief description of your concern

Once done, click the Schedule Event button below.

STEP 8: After completing the Calendly form, the Client will receive an email confirming the scheduled call.

At the same time, the Partner Advisor will also be notified by Calendly of the schedule set by the client.

A. In this example, the Client requested a GOOGLE MEET meeting.

B. This example shows that the client opted for the Advisor to CALL the client instead of meeting online.

STEP 9: Once the client’s payment has been confirmed, Calendly will automatically send a follow-up email to remind the Client of the schedule and to ask whether the Client has settled the consultation fees.

The Advisor must acknowledge receipt of payment and is expected to attend the scheduled meeting.

On the other hand, if the payment has not been made within a specific timeframe, the Advisor will CANCEL the booking of the client by sending a reply-all email informing the client and JuanTax Support of the cancellation.

ORIGINAL EMAIL:

ADVISOR’S REPLY-ALL EMAIL (client and JT support are informed)

Hello [Client]

I may have missed it, but for some reason, we did not receive the proof of payment before the said schedule. I will cancel this booking for now, but please feel free to schedule another call and follow the instructions given in the email.

Hope to meet you some other time.

Helpful Links: