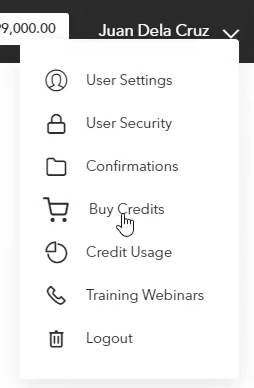

STEP 1: Click on your Account Name then choose Buy Credits.

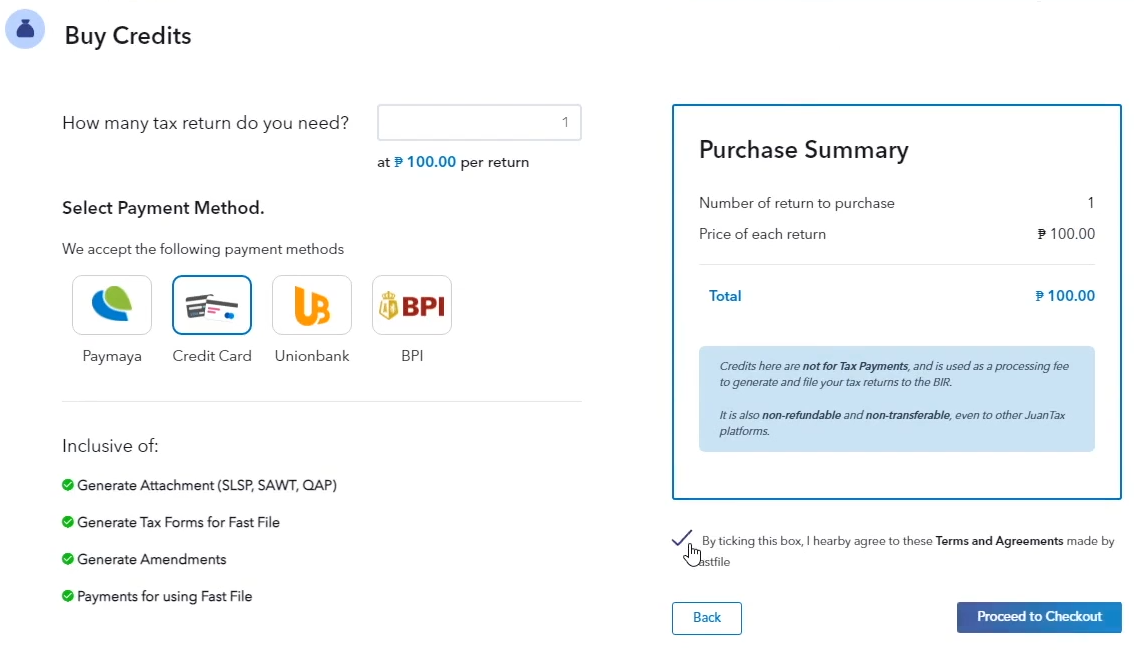

STEP 2: Enter the number of tax returns you need to generate, choose Credit/Debit Card as your payment method, then click the Terms and Agreements checkbox.

Before clicking the Proceed to Checkout button, take note of the following reminders:

Credits are not for tax payments and are used as a processing fee to generate and file your tax returns with the BIR. It is also non-refundable and non-transferable, even to other JuanTax platforms.

Credits are not for tax payments and are used as a processing fee to generate and file your tax returns with the BIR. It is also non-refundable and non-transferable, even to other JuanTax platforms.

What your credits can be used for:

What your credits can be used for:

Generation of Attachment (SLSP, SAWT, QAP)

Generation of Tax Forms for Fast File ONLY

Generation of Amendments

Payments for using Fast File

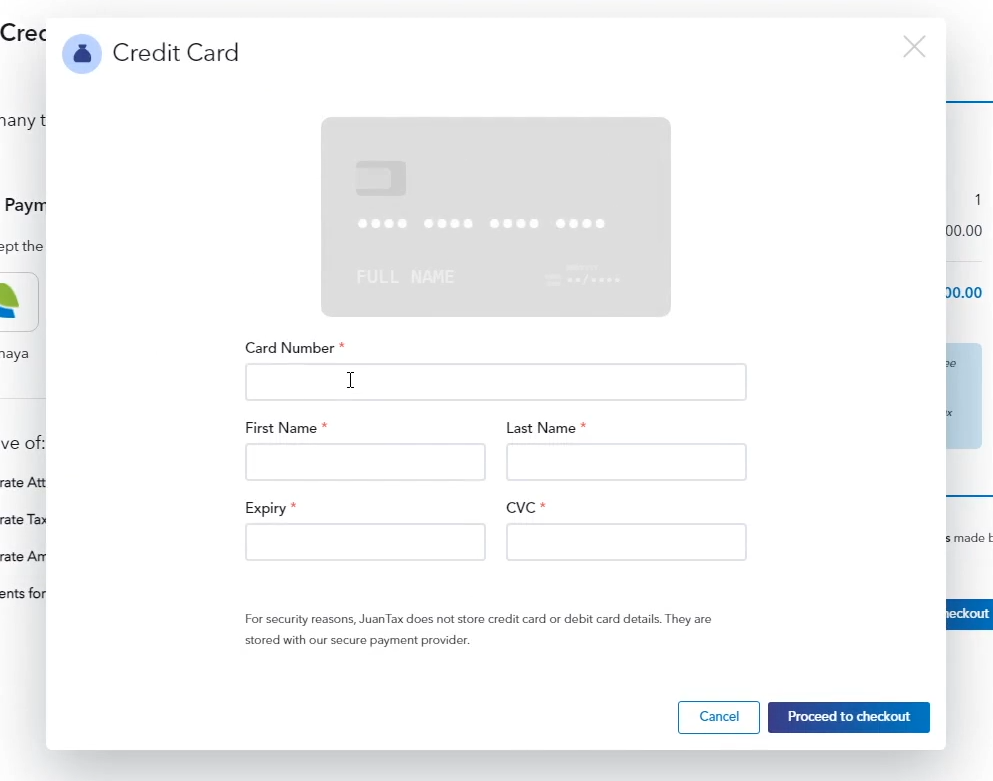

STEP 3: We’ll need you to enter your card details, which can be found on your physical bank card.

This includes your:

Card number

Full Name - as it is shown on the card

Card Expiration - if your card expires 12/25, you select 12 (or December) as your expiration month and 2025 as your expiration year

CVC - also known as CVV2, CVC2, or CID. On the back of the card, there is a series of printed numbers. The last three printed numbers are the code you want.

Give the system a few seconds to load. Once the top-up is successful, a pop-up screen with the transaction details will appear, and your Fast File dashboard will reflect the new total balance.

Important Information:

You need enough credits in your Fast File account to be able to file and pay your tax forms to BIR.

You can also buy credits for your Fast File account using PayMaya or through your UnionBank account.

Disclaimer: All tax payments made through the JuanTax platform will be processed by BIR-accredited e-payment providers such as UnionBank, GCash, PayMaya, and others.

JuanTax has partnered with payment services that have been BIR-accredited for e-payment, allowing us to facilitate such payments.

Helpful Links: