BIR Form 1601-EQ, or the Quarterly Remittance Return of Creditable Income Taxes Withheld, is a tax form that can be used to remit taxes that are withheld during the 3rd month of each taxable year.

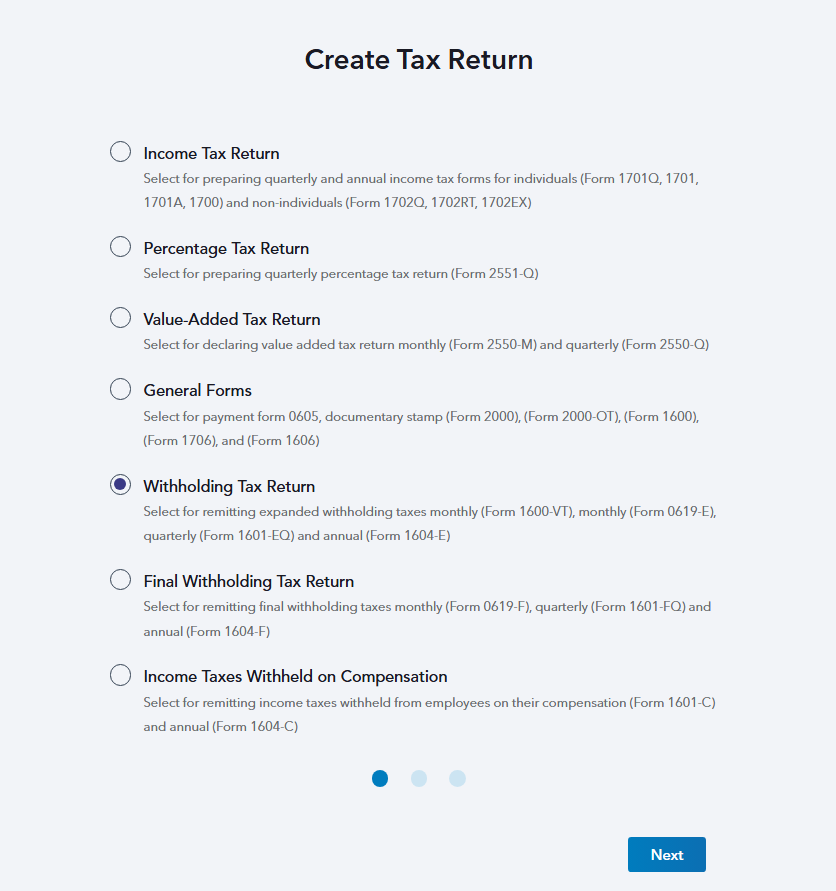

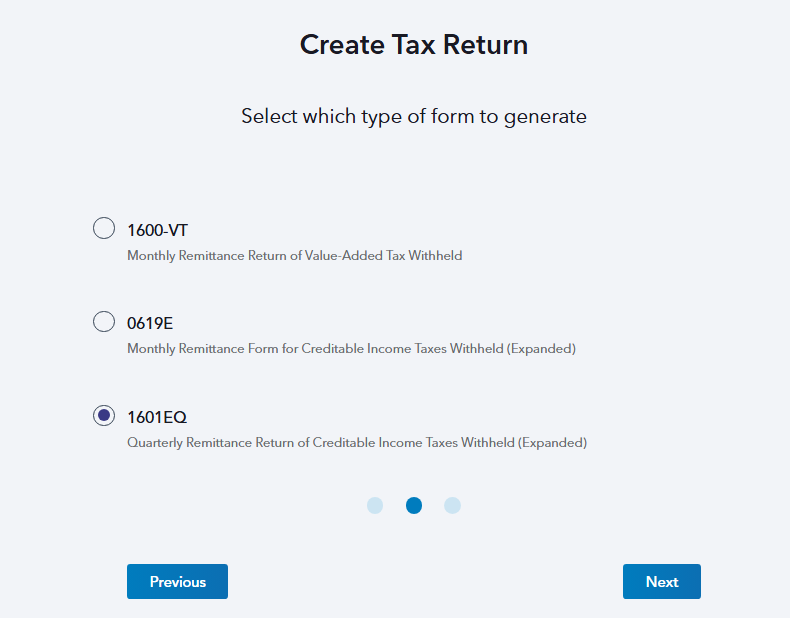

To start generating your 1601-EQ report, you'll just have to access your dashboard and go to Withholding Tax Return, then proceed to the 1601-EQ tab.

Follow these steps in creating your 1601-EQ report:

STEP 1: Click Plus Icon (+) Generate Report, then click Accept and Continue

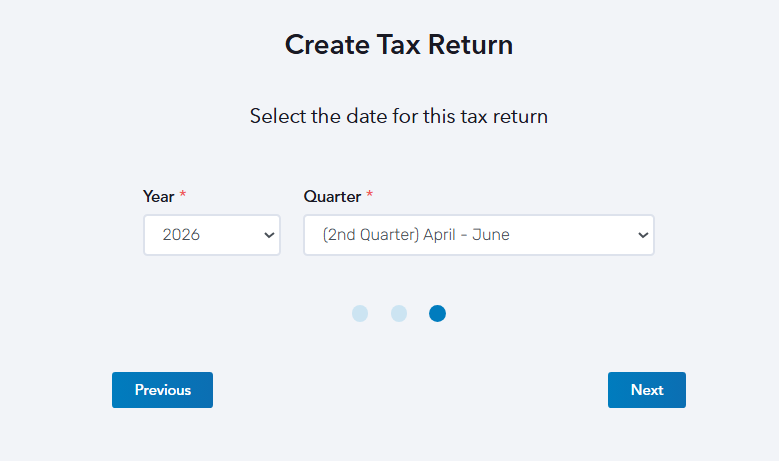

STEP 2: Select the Month and Year, click Generate

You can start adding transactions by either:

By adding them manually

By importing CSV format transactions

In the QAP Data section, you can start creating reports:

STEP 1: Click plus icon (Add Transaction) or the Create Transaction button

STEP 1A: Select a Vendor or Add Vendor

or

STEP 1B: If the vendor isn't a part of your contacts, you can easily add them by clicking the Add as New Contact

STEP 1B: Fill out all the important information about the vendor. Click the Save button to continue

STEP 2: Add other information such as Description, Reference No., Date, Amount, and ATC, Click Save

STEP 4: You can edit, delete, bulk edit, export, search, and navigate through your transactions list

You can also access a preview of the actual report by clicking on the Report tab next to Summary.

An over-remittance will be shown in your report in the form of a negative number and is located in Section 25 as well as reflected in Section 30 of your 1601-EQ form.

You have the option to choose whether your amount should

(1) refunded

(2) issued tax credit certificate

(3) carried over the next quarter

Notes and Activity

To see the audit trail of activities made within the report, all you need to do is click the Notes & Activity tab.

Check out this article for a step-by-step guide on filing taxes with Plus.

Follow the instructions in this article to pay your filed tax return in JuanTax.